Utah’s Economic Outlook is Strong and Positive!

Each year, CBRE and the Salt Lake Chamber combine efforts to produce the Economic Outlook for the upcoming year. This report covers many areas impacting our economic future so informed strategic planning for 2015 can occur. Included in this report are the traditional topics of labor, demographics, geopolitical factors that provide an understanding for moving forward in a dynamic, global environment. We have selected three areas to highlight:

-

GDP growth productions,

-

Venture capital growth in Utah, and

-

Large capital projects

These three areas can spark ideas and plans to increase your company’s revenue.

GDP Growth Projections

By year end 2014, 2.0% GDP growth is expected in the US which is below the predictions that occurred at the beginning of 2014. The good news is that the 2015 GDP growth projections should continue to grow at a more rapid pace around 3%. CEO’s remain optimistic about sales revenue but only 39% of the CEO’s surveyed expect to increase their capital spending. Optimistic but cautious is the sentiment. As a nation, we are moving in a positive direction with respect to growth with a concerted effort to make wise, calculated decisions and not fall back into old ways of doing business that led into a long recession. Steady, modest growth is likely the norm for the US economy in the upcoming years.

Venture Capital in Utah

Growth in venture capital in the State of Utah continues and is one of the dynamic engines that keep Utah growing at a fast pace. The amount of capital infused into new companies within a smaller populated state is impressive. Third quarter 2014 funding outstripped funding raised in the entire year of 2013. Here are a few notable examples:

-

Domo raised $100M

-

Pluralsight raised $135M

-

Qualtrics raised $150M

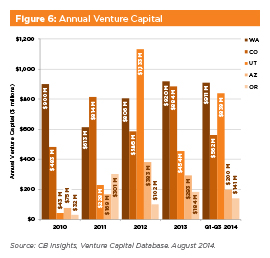

Our local clients are also receiving funding from venture capital and growing which is translating into new employees being hired and an immediate need for new space. The technology sector is the beneficiary of venture capital and has been nicknamed “Silicon Slopes”. Through the efforts of the Utah Technology Council and the Governor’s office, Utah technology companies have benefited and are key drivers in our State’s economy. Each technology innovation creates five additional jobs. This is a great driver for growing Utah’s economy. About 5% of Utah employees hold tech related jobs. The associated tech job annual wages is $71,231.00 which is 167% of Utah’s annual wages. The other impressive statistic is that one of every ten companies in Utah is tech related. Tech related companies are hiring at twice the rate of other industries. Consider the chart below showing how Utah companies compare to other companies in surrounding western states receiving venture capital. Utah ranks second behind Washington State. This is very significant.

Venture Capital will continue to be attracted to Utah. Technology companies will keep growing, and our local economy will flourish. Growth of tech companies will not be limited to Utah County as we experience, for example, much office space is being absorbed in downtown Salt Lake City by tech companies such as Ancestry, Alliance Networks, Aviacode, EA Sports, Inside Sales, Venafli, and Workday.

Increase of Capital Projects

Tech is fueling the Utah economy. However, large capital projects in Salt Lake County will further accelerate economic growth. Millions of dollars are being infused in the projects listed below creating many jobs. These projects include:

-

Salt Lake International Airport

-

Convention Center Hotel

-

Performing Arts Center

-

111 Tower

-

Cottonwood Mall Redevelopment

-

University of Utah Campus and Healthcare Expansion

The economic outlook is not only positive, but it is strong. Our future is bright! For additional information, please read the attached report. For your office and investment needs, call the Johnson and Galanis Team. We listen and develop solutions for your real estate needs.

CLICK HERE to download the full Economic Outlook Report

|

|

|