PARTNERING FOR PATIENT CONVENIENCE

|

Most retail in healthcare discussions today are focused on integrating ambulatory care into traditional retail settings or repurposing retail space for medical office use. Another trend that is not as well noted is the migration of retailers onto acute care campuses.

On-campus Medical Office Buildings (MOB) have traditionally been designed to squeeze as many physicians as possible into a designated space. This approach ensured that physicians were bonded to a particular hospital thus leading to admissions and other “downstream” revenue. To accommodate this model, the design of most MOBs limited public spaces, lobbies and other amenities.

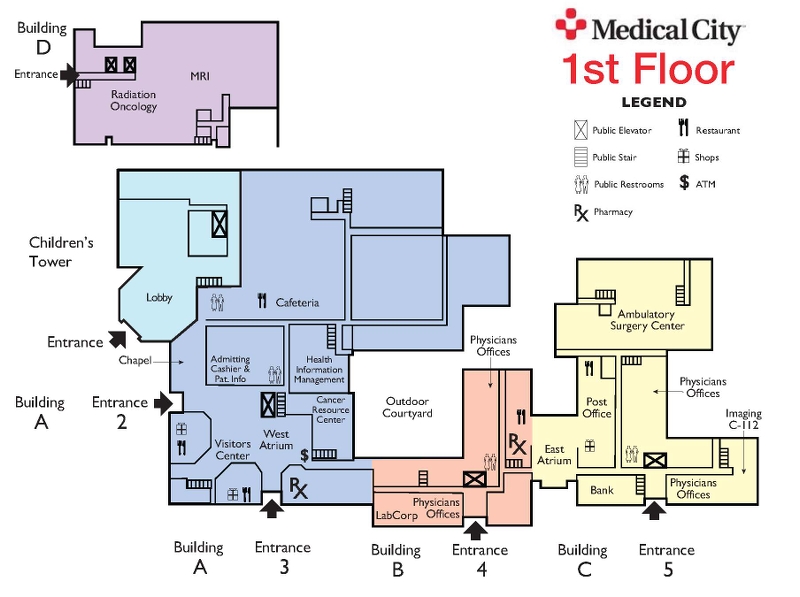

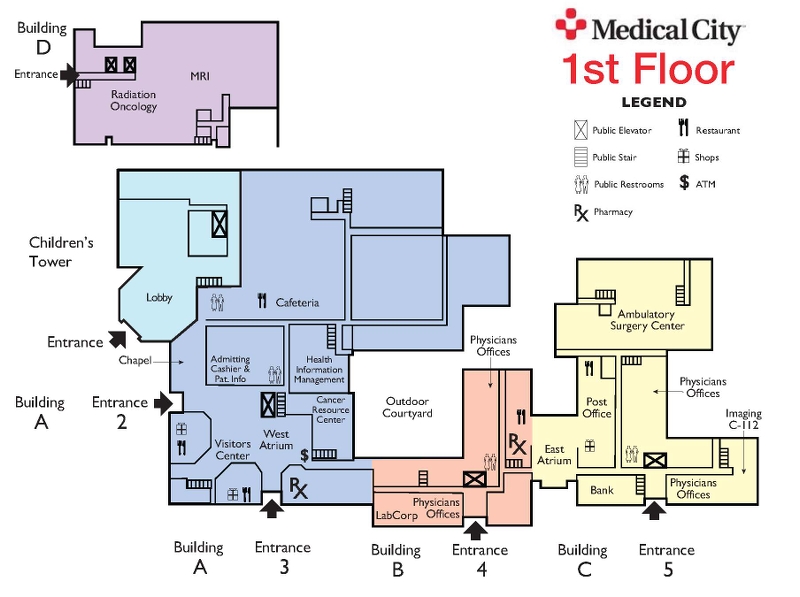

One notable exception to this rule is Medical City located in Dallas, Texas. Medical City pioneered the concept of ground floor retail as part of the medical center campus. As you open the door to the “City” you will find a different type of atmosphere; it not only looks like, but also has services of a Five Star hotel. 12 retailers are located within the City. You can find everything from shoe shining to flower/gifts to tacos. Although viewed as innovative and highly successful when it first opened in the 1980’s, no other healthcare provider has been able to emulate the success that this concept has achieved. One notable exception to this rule is Medical City located in Dallas, Texas. Medical City pioneered the concept of ground floor retail as part of the medical center campus. As you open the door to the “City” you will find a different type of atmosphere; it not only looks like, but also has services of a Five Star hotel. 12 retailers are located within the City. You can find everything from shoe shining to flower/gifts to tacos. Although viewed as innovative and highly successful when it first opened in the 1980’s, no other healthcare provider has been able to emulate the success that this concept has achieved.

In the early 1990’s, hospitals began decanting outpatient services from the inpatient facilities into on-campus medical office space. This move put new demand on ground floor space for surgery centers, imaging and urgent care centers. To open up these spaces, hospitals displaced non-admitting physicians and ancillary health professionals. As health systems now look to more distributive strategies for these services and physicians consolidate their practices, more space is becoming available within existing campus facilities. It is only logical that building owners are beginning to consider other uses to backfill these spaces in ways that benefit both employees and visitors and enhance building revenue.

Some uses are obvious and have a natural affinity for locating in a medical office building. For instance, Pharmacies and Urgent Care Centers have a strong desire for first floor space and the possibility for separate access to allow for extend ed hours. ed hours.

“Having Walgreens within the Medical Office Building at Northwestern is extremely convenient for patients as they can pick up their prescriptions prior to leaving the campus. In addition, there is growing evidence that this convenience increases patient compliance with their drug regimen,“ noted Skender Rugova, Senior Director responsible for the facility.

But, of equal importance is the question of what opportunities exist for partnering with non-traditional retailers that might be a good fit for a healthcare campus? This was the challenge presented by a healthcare REIT to its leasing team.

As this was outside the mainstream of medical office leasing, a team that included the owner, a healthcare and life science expert and retail specialist were convened to create a list of prospective non-physician tenants for an on-campus medical office buildings.

ADDING RETAIL TO THE MIX

With a focus on businesses that would be attractive to patients and staff, the team looked beyond the traditional type of tenants to identify 12 prospective “verticals”. Prospects included a range of services from financial to food and even included potential competitors such as dialysis, surgery centers and allied health services. While some services were currently availability onsite, opportunities existed to provide a more user friendly environment and thus improve the overall campus experience.

Most campuses have a single point of food service, the hospital cafeteria. Usually located in the basement and positioned primarily to serve inpatients and employees, campus visitors typically find their location to be remote and inconvenient.

Medical campuses generate considerable daily foot traffic from employees, patients and visitors. Hospitals average about 4-5 employees per bed and physicians are typically supported by 2.5 employees. Combine this with a physician seeing approximately 30 patients a day and you can see how the numbers begin to add up. Some large campuses may have more than 10,000 employees and visitors per day.

On the list of 12 verticals identified, food services topped the chart with 19 separate vendors. Given the focus for healthcare systems to encourage healthy living, the list excluded most of the well-recognized fast food names and concentrated on those firms that provided predominately healthy items on their menus. Initial reactions from the firms were that the campus locations were too far outside the norm for their consideration. However, a few were willing to think outside the box and decided it was worth an additional feasibility study.

One such participant, Subway, which already has a history of locating in non-traditional venues, was the first to step up to the plate. They recently opened a store in Indianapolis on the St. Vincent’s Healthcare campus. Subway is now considering other locations throughout the country (as well as with the health system) and has demonstrated to other organizations the value that these nontraditional sites may hold.

Oregon Health & Science University (OHSU) has two campuses – Marquam Hill and South Waterfront – that are connected via the Portland Aerial Tram. Due to the separation of campuses, OHSU has recognized the importance of providing retail amenities to those who work and visit the South Waterfront campus. Some of the first tenants to open included a coffee shop, deli and a café. “It’s been a great strategy for OHSU to designate space to provide amenities for their patients and visitors while also having the benefit of generating revenue,” said Dyann Hamilton, Senior Director for OHSU.

OPPORTUNITIES WITH COMMERCIAL PHARMACIES

There is considerable evidence that patients who are compliant with their prescription medicines have significantly better outcomes than those who aren’t. As health systems take greater risk and responsibility for the health of the populations they manage, they have recognized it’s more important to partner with those who can assist in this objective rather than trying to preserve the turf of the hospital based pharmacy.

Traditionally, hospitals have viewed commercial (chain) pharmacies as competitors and chains have not shown interest in hospital/medical spaces. Both of these views have changed dramatically within the last two-three years.

The major pharmacy chains have recently shown an interest in locating on hospital campuses. Walgreens and CVS are the forerunners in capitalizing on these non-traditional spaces. They have demonstrated value to health systems in their ability to achieve a much higher prescription fulfillment rate than a hospital based pharmacy operating in the medical space. The major pharmacy chains have recently shown an interest in locating on hospital campuses. Walgreens and CVS are the forerunners in capitalizing on these non-traditional spaces. They have demonstrated value to health systems in their ability to achieve a much higher prescription fulfillment rate than a hospital based pharmacy operating in the medical space.

The fulfillment rate of prescriptions after an ambulatory procedure or doctor visit is surprisingly dismal. Less than 50% of patients actually fill their prescriptions. When locating on a campus, the major chains have developed protocols and partnerships with the hospital to assist in filling prescriptions by actually delivering them to the patients prior to discharge after an ambulatory procedure. With electronic ordering, prescriptions can be ready for pick up within the building after visiting a doctor. The chain pharmacies have created robust information systems that are capable of tracking and following up with patients for refills and directing them to a pharmacy close to their homes. doctor. The chain pharmacies have created robust information systems that are capable of tracking and following up with patients for refills and directing them to a pharmacy close to their homes.

Times are changing for medical real estate. Opportunities to look beyond the traditional health services are growing at a furious rate. Early success with these two verticals may well serve as an indicator of the future for other “retail” uses. Other potential partners that should be considered include banking and financial services, vision care, dry cleaning and laundry services, UPS stores and spa services. Healthcare systems that look “outside the box” when developing their facilities strategies will be the leaders in today’s ever changing environment.

Click here to subscribe to our mailing list.

As a Managing Director with CBRE Healthcare, Craig oversees the development and management of a broad range of real estate with a focus on healthcare and institutional projects. Craig’s responsibilities include the development of hospital, medical office and ambulatory facilities. In addition, he has led the resolution of a variety of work-out situations including construction completion, financial restructuring and dispositions. As a Managing Director with CBRE Healthcare, Craig oversees the development and management of a broad range of real estate with a focus on healthcare and institutional projects. Craig’s responsibilities include the development of hospital, medical office and ambulatory facilities. In addition, he has led the resolution of a variety of work-out situations including construction completion, financial restructuring and dispositions.

Craig has developed an expansive resume of OSHPD experience over the past 30 years. Projects range from the $800 million replacement of Cottage Hospital in Santa Barbara to a remodeling of the Emergency Department at Huntington Park Hospital in Los Angeles.

Since the Northridge earthquake, Craig has been intensely involved in the seismic planning and campus master planning required to meet the SB 1953 requirements for over 30 hospital campuses. He is engaged in the planning and interfaces with OSHPD on the Verdugo Hills voluntary seismic upgrades currently underway.

In addition to his hands on experiences with OSHPD, Craig has participated in the creation of policy - assisting in the development and interpretation of PINS and formatting of reporting requirements. He is the originating Chair and continuing member of the California Hospital Associations OSHPD task force which serves as a liaison between OSHPD senior management and the major health systems in California. He is also a co-author of a California Hospital Association publication “Best Practices for dealing with OSHPD”.

Craig started his career in real estate in 1977 as Chief Financial Officer of Concordia Development, a real estate development company based in Southern California. As President of Beam & Associates since 1983, he had overall responsibility for the consulting, development, leasing and brokerage divisions of the firm. Craig has worked for major systems including Saint Joseph Health System of Orange, Ascension Health and Catholic Healthcare West. Mr. Beam is a licensed California real estate broker and holds the professional designation of Counselor of Real Estate.

In addition to his real estate activities, Craig has served on numerous boards including the advisory board to the Director of the National Institutes of Health, UniHealth, Pacificare and Martin Luther Hospital. He is past Chairman of the Board of the American Heart Association and is currently the Treasurer of the World Heart Federation.

Craig holds a Bachelor of Science degree in Business Administration from California State University, Fullerton.

For more information about Partnering for Patient Convenience, please contact Craig Beam, Managing Director at Craig.Beam@cbre.com

|

|

|

|

CBRE HEALTHCARE PERSPECTIVES

Are you looking for an article that ran last year? We have all previous articles of CBRE Healthcare Perspectives posted on our website. If you have any questions contact Susan Wadsworth, Director, Marketing

Click here for more information.

|

EDUCATIONAL INSIGHTS

All educational sessions are geared to assisting clients and industry partners in gaining a better understanding of the issues related to the Healthcare real estate and capital facility process. Sessions are free of charge, the only investment is your time.

Click here for more information.

|

| |

|

INTEGRATED PROJECT DELIVERY

Integrated Project Delivery (IPD) has gained popularity over the years. CBRE Healthcare started a forum for open discussion on IPD, a place to explore the benefits of IPD, lessons learned from projects, and the real value IPD has to offer. Join the conversation and offer insights from current or past projects.

Click here for more information.

|

|

|

|

|

FOLLOW US ON TWITTER

See what's going on within CBRE Healthcare and how we can provide real advantage to the healthcare real estate and capital facility process.

Click here for more information.

|

FOLLOW US ON LINKEDIN

Don't have Twitter? We are also on LinkedIn. Get CBRE Healthcare project updates, major news, and job listings.

Click here for more information.

|

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (in terms of 2013 revenue). The Company has approximately 44,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through approximately 350 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.com.

|

ed hours.

ed hours.

The major pharmacy chains have recently shown an interest in locating on hospital campuses. Walgreens and CVS are the forerunners in capitalizing on these non-traditional spaces. They have demonstrated value to health systems in their ability to achieve a much higher prescription fulfillment rate than a hospital based pharmacy operating in the medical space.

The major pharmacy chains have recently shown an interest in locating on hospital campuses. Walgreens and CVS are the forerunners in capitalizing on these non-traditional spaces. They have demonstrated value to health systems in their ability to achieve a much higher prescription fulfillment rate than a hospital based pharmacy operating in the medical space. doctor. The chain pharmacies have created robust information systems that are capable of tracking and following up with patients for refills and directing them to a pharmacy close to their homes.

doctor. The chain pharmacies have created robust information systems that are capable of tracking and following up with patients for refills and directing them to a pharmacy close to their homes. As a Managing Director with CBRE Healthcare, Craig oversees the development and management of a broad range of real estate with a focus on healthcare and institutional projects. Craig’s responsibilities include the development of hospital, medical office and ambulatory facilities. In addition, he has led the resolution of a variety of work-out situations including construction completion, financial restructuring and dispositions.

As a Managing Director with CBRE Healthcare, Craig oversees the development and management of a broad range of real estate with a focus on healthcare and institutional projects. Craig’s responsibilities include the development of hospital, medical office and ambulatory facilities. In addition, he has led the resolution of a variety of work-out situations including construction completion, financial restructuring and dispositions.