| The Philadelphia region is closing in on a record for the longest stretch of job growth in the last half century.

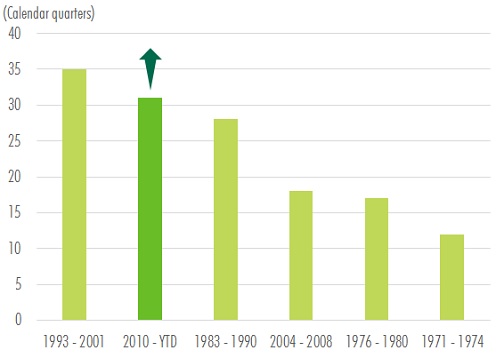

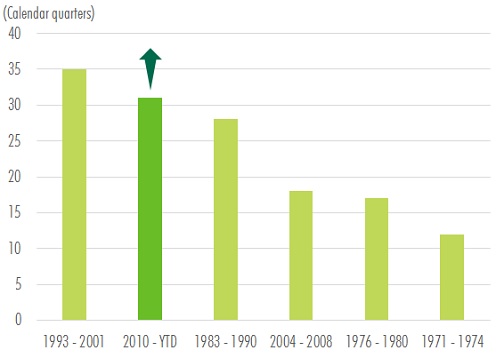

Figure 1 shows the longest expansions in the metro's employment base since 1970, including our current one of 31 consecutive quarters of annual growth. Surpassing the 1990's boom - or at least tying - certainly looks attainable with a favorable near-term economic outlook.

| X |

Figure 1: Job Growth Expansions

Consecutive quarters of year-over-year job growth since 1970 |

|

| (Source: U.S. B.L.S., CBRE Research) |

| X |

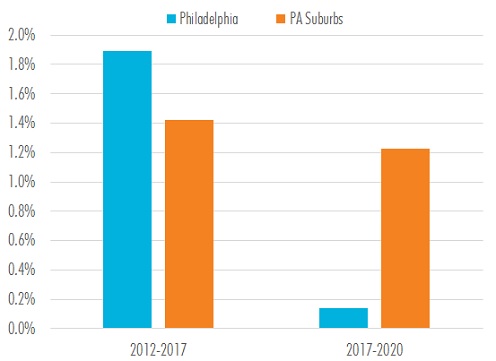

But the geography of the economic expansion is changing.

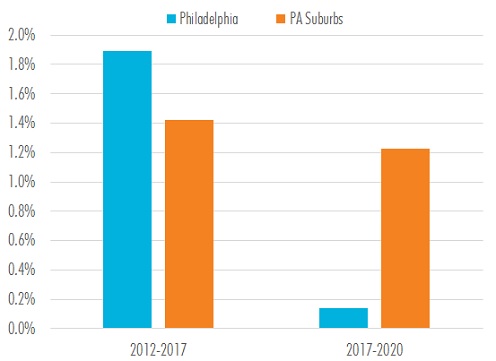

The Philadelphia metropolitan division (comprising Philadelphia and Delaware counties) had been the dominant, office-using job generator since the Great Recession, but over the past two years, has decelerated somewhat rapidly.

In the suburbs, however, office-using employment growth (professional and business services, financial activities, information) has remained more resilient, usurping the urban core as the region's office job engine.

In fact, forecasts call for over two-thirds of all new office jobs in the region to be created in the suburbs by the end of 2020. |

| X |

Figure 2: The Suburbs Shine

Average annual rates of office-using employment growth |

|

| (Source: U.S. B.L.S., Moody's Analytics; Note: "Philadelphia"=Philadelphia Metro Division including Delaware County, "PA Suburbs"= Montgomery-Bucks-Chester counties Metro Division) |

| X |

This city-suburban role reversal in terms of where the office jobs are being created isn't unique to Philadelphia.

The same phenomenon is occurring in almost every major metropolitan area where the metropolitan division containing the primary city is decelerating and its outlying, suburban metropolitan divisions are either accelerating, or now exceeding, the urban core in terms of office-using employment growth.

A recent Brookings report shows a similar trend regarding population growth, in which the rate of growth in most U.S. cities has reversed course and is now declining while the suburbs are growing faster.

Some of the "push" of the expansion into outlying areas is caused by urban labor constraints, higher prices and costs, and a continually improving single-family housing market.

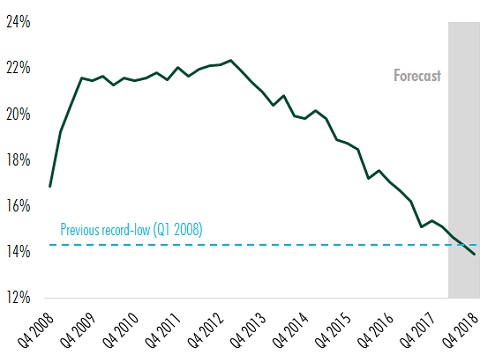

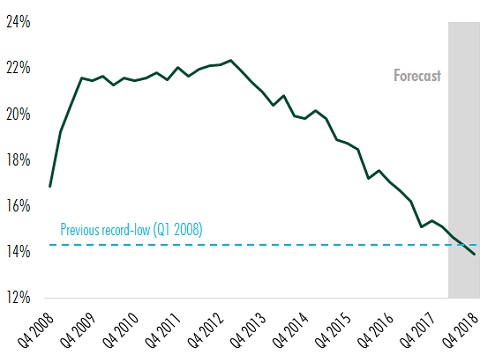

Regardless the specific reason, the push into the suburbs is on. As a result, CBRE Research is forecasting lower office vacancy rates in Suburban Philadelphia through the end of 2018. The amount of vacant office space available for tenants at the end of the year should be the lowest it's been since the early 2000s. |

| X |

Figure 3: Record-low vacancy

Suburban Philadelphia Office Vacancy |

|

| (Source: CBRE Research) |

| X |

Contact:

Ian Anderson

Director of Research and Analysis

T + 1 215 561 8997

ian.anderson2@cbre.com |

|  |

|

|

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330).

Please consider the environment before printing this email.

CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166.

Address: Two Liberty Place, 50 S. 16th Street, Suite 3000 Suite 700, Philadelphia PA 19102

© 2025 CBRE Statistics contained herein may represent a different data set than that used to generate National Vacancy and Availability Index statistics published by CBRE Corporate Communications or CBRE's research and econometric forecasting unit, CBRE Econometric Advisors. Information herein has been obtained from sources believed reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the market. This information is designed exclusively for use by CBRE clients, and cannot be reproduced without prior written permission of CBRE.

CBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners.

Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

|