|

|

|

L. Heath Chapman, CCIM |

Don Shupe |

Presenting CBRE's MarketStrike

What is MarketStrike?

MarketStrike is a proprietary program to CBRE and is the commercial real estate industry’s first and only portfolio analysis tool that helps our clients manage strategic real estate decisions about how and when to renegotiate, renew, or exit leases. Using CBRE’s Econometric Research knowledge coupled with our industry-leading economic forecasting, MarketStrike allows us to determine whether current and future contract rents are equal to, above or below market levels.

What are the benefits of MarketStrike?

With MarketStrike, our clients are able to keep abreast of changing local market conditions and proactively identify market opportunities across an entire portfolio, rather than simply focusing on upcoming expirations. Using MarketStrike, we have found that there is typically a 10-15% gap between market and contract rent, and in some cases MarketStrike has uncovered millions of dollars in total occupancy savings for our clients.

The MarketStrike tool integrates portfolio lease data with detailed historical and forecasted market data in virtually any market across the globe to:

-

Measure gaps between contract rents and market rates

-

Develop detailed portfolio strategies

-

Estimate potential savings and quantify results

-

Prioritize and execute opportunities

-

Anticipate future market conditions at the submarket level

-

Analyze multiple property types

-

Run sensitivity analyses of lease terms in negotiation

-

Improve the accuracy of corporate planning and budgeting

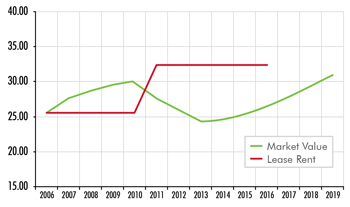

Historical and Projected Analysis of Each Specific Lease

MarketStrike provides a customizable analysis of the full rent stream of each lease as compared to market value–taking all characteristics of each lease into consideration.

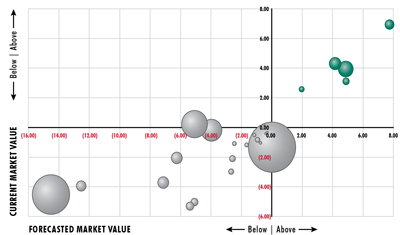

Comparative Analysis of an Entire Portfolio

Provides a unique look at how each particular lease in a client’s portfolio compares to current and future market rates – as well as the relative value of each lease’s deviation from market rental rates.

Please contact us to set up a demonstration showing how MarketStrike can help expose opportunities to create measurable savings within your real estate portfolio.

CONTACT US

Please contact us by email at heath.chapman@cbre.com or don.shupe@cbre.com or by phone at 919.831.8200 to obtain a CBRE Econometric Advisors Index Brief, as well as CBRE’s local 1Q 2013 Office MarketView Report. These reports provide key updates on vacancy levels, rental rates and employment trends within the Raleigh-Durham office market.

The Raleigh-Durham office market continues to rapidly evolve, and we make it our business to stay ahead of the curve. If you anticipate a change in your space requirement, have been contemplating a lease restructure, or simply desire an overview of current market conditions, please contact us.

We specialize in tenant advisory and are committed to delivering superior results for our clients.

|

| Team Overview | |

| Team Members | |

| Market Coverage | |

| Resources | | |

|

| Subscribe | |

||||

|

CBRE | Raleigh 4208 Six Forks Road | Suite 1220 Raleigh, NC 27609 | 919.831.8200 | www.cbre.com/raleigh |