|

|

A NOTE FROM JAMES

Sublease Availabilities Continue to Increase in Q4

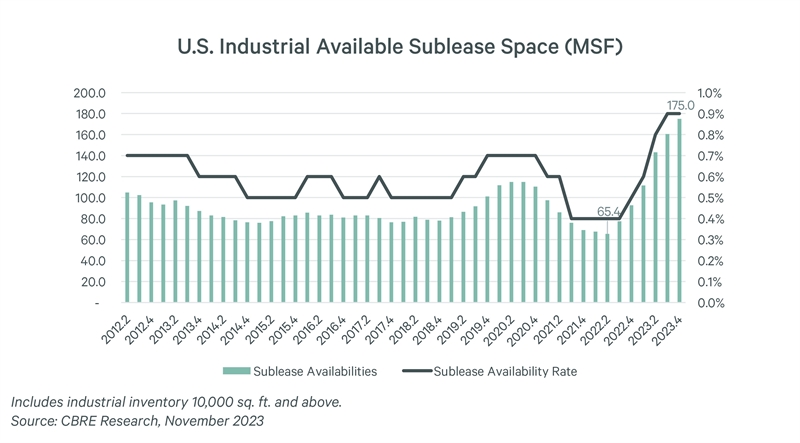

Available industrial sublease space continues to increase as some occupiers adjust domestic inventory strategies. At the end of November, a record 175 million sq. ft. was available for sublease, 8.9% higher than the end of Q3. Despite the record square footage, this only represents an availability rate of 0.9%. Furthermore, only a little over half of this space is vacant with vacancy rates for sublease space at 0.5%.

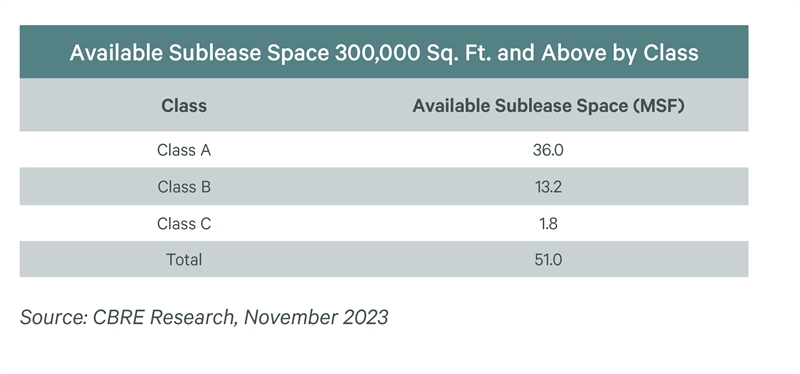

Spaces 300,000 sq. ft. and above make up a significant portion of available sublease space, finishing November with 106 availabilities totaling 51 million sq. ft., higher than the 94 availabilities totaling 45 million sq. ft. at the end of Q3. Most of the available sublease space over 300,000 sq. ft. is in newer class A facilities, which account for 70.5% of the total.

Spaces 300,000 sq. ft. and above make up a significant portion of available sublease space, finishing November with 106 availabilities totaling 51 million sq. ft., higher than the 94 availabilities totaling 45 million sq. ft. at the end of Q3. Most of the available sublease space over 300,000 sq. ft. is in newer class A facilities, which account for 70.5% of the total.

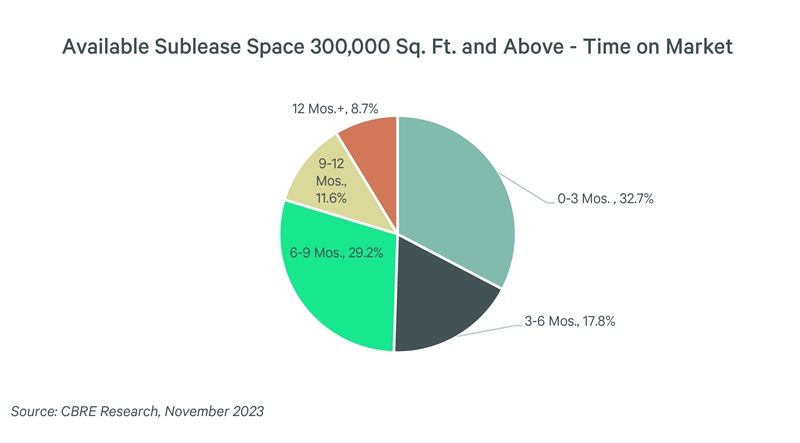

32.7 million sq. ft. of sublease space over 300,000 sq. ft. was added the past 90 days, while just under 30% has been on the market for 6-9 months. The 6-to-9-month period falls mainly within Q2 2023 which remains the quarter with the largest increase in sublease space since the onset of the pandemic. The Inland Empire, which was one of the most active markets for new leasing for product 300,000 sq. ft. and above, also leads in available sublease space at 8.9 million sq. ft., up from 6.1 million sq. ft. at the end of Q3. It is also nearly double the available sublease space compared with second place Atlanta at 4.9 million sq. ft.

32.7 million sq. ft. of sublease space over 300,000 sq. ft. was added the past 90 days, while just under 30% has been on the market for 6-9 months. The 6-to-9-month period falls mainly within Q2 2023 which remains the quarter with the largest increase in sublease space since the onset of the pandemic. The Inland Empire, which was one of the most active markets for new leasing for product 300,000 sq. ft. and above, also leads in available sublease space at 8.9 million sq. ft., up from 6.1 million sq. ft. at the end of Q3. It is also nearly double the available sublease space compared with second place Atlanta at 4.9 million sq. ft.

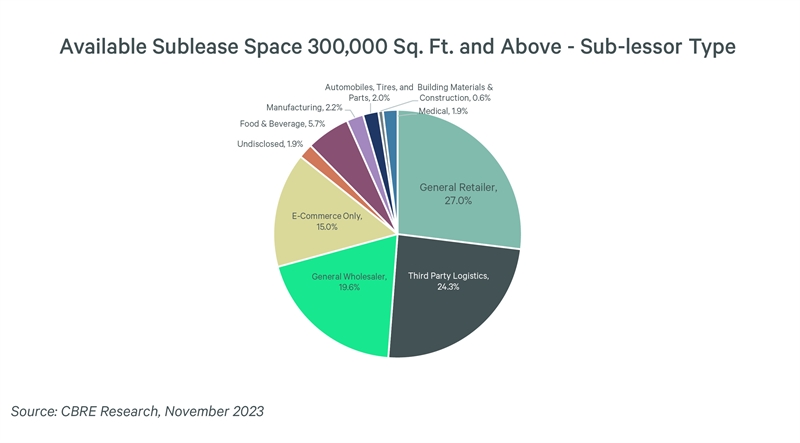

3PLs have been the most active sublessors the past 90 days adding 12 facilities over 300,000 sq. ft. to the market totaling 4.9 million sq. ft. 3PLs account for 24.3% of the available sublease space 300,000 sq. ft. and larger, slightly lower than General Retailers who account for 27.0%. While sublease space has continued to increase in Q4, we expect this to slow and stabilize in the coming months on the heels of a strong holiday retail season and more economic clarity.

3PLs have been the most active sublessors the past 90 days adding 12 facilities over 300,000 sq. ft. to the market totaling 4.9 million sq. ft. 3PLs account for 24.3% of the available sublease space 300,000 sq. ft. and larger, slightly lower than General Retailers who account for 27.0%. While sublease space has continued to increase in Q4, we expect this to slow and stabilize in the coming months on the heels of a strong holiday retail season and more economic clarity.

|

NEWS & HEADLINES

The Worlds Key Canal is Clogging Up. Winter Fuel Prices Could Get Wacky

Climate change may be making winters more unpredictable. It could make your winter heating bills more unpredictable too, particularly if you live at the end of long and vulnerable fuel supply chains.

Click here to read more

Yellow Rivals Scoop Up Truck Terminals in Bankruptcy Auction

Yellow is set to raise more than $2 billion after a bankruptcy auction that will disperse much of its national network of truck terminals among rivals, casting deeper doubt on a long shot bid to revive the trucker.

Click here to read more

Goods Deflation is Back. It Could Speed Inflation’s Return to 2%

After a historic run-up in inflation, Americans are now starting to see something they haven’t in three years: deflation. To be sure, deflation—that is, falling prices—is largely confined to appliances, furniture, used cars and other goods. Economywide deflation, when prices of most goods and services continuously fall, isn’t in the cards.

Click here to read more

|

RECENT CBRE RESEARCH

Emerging Industrial Markets: Kansas City

Kansas City has become a key logistics hub for many automotive suppliers, distributors and 3PLs due to its strong infrastructure and location. Four major interstates bisect the city and multiple rail intermodal facilities connect to major ports in the U.S., Canada and Mexico. Ninety percent of the U.S. is reachable within a two-day drive, making distributor coverage from coast to coast possible.

Click here to read more

CBRE Q3 Capital Markets Figures Report

- U.S. commercial real estate investment volume fell by 54% year-over-year in Q3 to $82 billion.

- Multifamily was the most preferred sector with $29 billion in Q3 volume, followed by industrial & logistics with $20 billion and retail with $15 billion.

- On a trailing-four-quarter basis, Los Angeles was the top market with $35.2 billion in volume, followed by New York with $34.7 billion.

Click here to read more

|

WEEKLY TAKE - PODCAST

Going the Distance: How one REIT makes investment decisions in a challenging environment

Dec 5 | 38 Minute listen - Kimco Realty’s (NYSE: KIM) President and Chief Investment Officer Ross Cooper says that retail and mixed-use property owners and tenants have become partners. In a wide-ranging discussion, he talks about the challenges facing real estate investors today, the evolution of the shopping experience and the possibilities for mixed-use properties.

Click here to listen.

|

|

Further Reading

|

|

|

|

|

OFFERING INTEGRATED REAL ESTATE CAPITAL MARKETS SOLUTIONS FROM STRATEGY TO EXECUTION – DELIVERED BY A SEAMLESS NATIONAL PARTNERSHIP |

|

|

|

|

Unsubscribe

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330). Please consider the environment before printing this email. CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166. Address: 1300 SW 5th Avenue, Suite 3000 Suite 700, Portland OR 97201

THIS IS A MARKETING COMMUNICATION © 2025 CBRE, Inc. All rights reserved. This information has been obtained from sources believed reliable but has not been verified for accuracy or completeness. CBRE, Inc. makes no guarantee, representation or warranty and accepts no responsibility or liability as to the accuracy, completeness, or reliability of the information contained herein. You should conduct a careful, independent investigation of the property and verify all information. Any reliance on this information is solely at your own risk. CBRE and the CBRE logo are service marks of CBRE, Inc. All other marks displayed on this document are the property of their respective owners, and the use of such logos does not imply any affiliation with or endorsement of CBRE. Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

|

|