Evolving Impact of Proposed Tariffs on the Medical Device Industry

The announcement of “Liberation Day” sent shockwaves through all sectors of global manufacturing, and the medical device industry was no different, with focus narrowing on impending tariff increases on imports. In the two weeks since the announcement the Trump Administration has wavered and paused on many, but not all, of the tariffs proposed. No medical device manufacturer is taking comfort in the current status quo….so, what is the potential impact on the medical device industry moving forward?

Interestingly, documented country-by-country tariff data prior to Liberation Day is relatively sparse, so we referred to thought leaders tangential to the companies impacted. Jason Miller, Professor of Supply Chain Management at Michigan State University’s Eli Broad College of Business and CBRE’s Senior Economic Advisor Richard Barkham, validated both the historically poor tracking of tariffs, as well as provided direction on where we as a country started with tariffs, at least in January of 2025. From there, coupled with PIERS data from S&P Global, we have drawn an initial set of conclusions as to the potential impact of these proposed tariffs for medical device companies importing into the U.S. We plan to continue to bolster and augment these conclusions as the proposed tariffs and the likelihood of their enforcement evolves. For the dataset contained herein, our focus was siloed to predominately the top twenty pure-play global medical device manufacturers based on 2024 gross revenue.

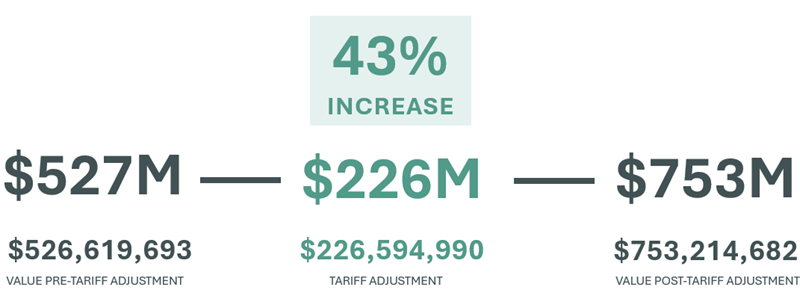

Existing Tariffs vs. Liberation Day Tariffs and Overall Cost Impact

The change to the average tariff currently applied by the U.S. across 234 countries and territories is 1.09%, with China and Bangladesh topping the list at 11% and 15%, respectively. Surprised? The average post Liberation Day tariff, for a reduced list released by the Trump Administration and news outlets reporting the ongoing activity, 17.23%. Looking at imports by medical device manufacturers just in Q1 ’25, this translates to a significant impact:

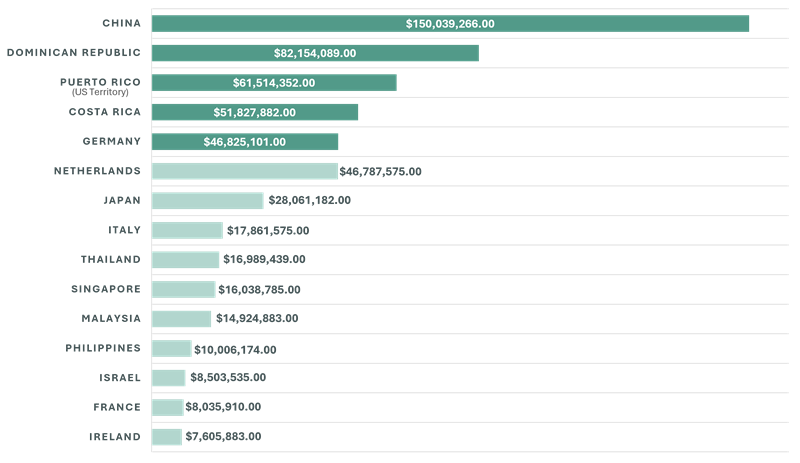

Countries Most at Risk for Cost Elevation by Estimated Import Value

The medical device manufacturing community has historically boasted a relatively cohesive and interdependent peer set, with a tendency to cluster in the same geographic areas. As a result, the countries in which the top 20 pure-play medical device companies manufacture are representative of what have effectively become industry geographic standards. The top 5 countries from which the greatest import value of medical device products is derived are China, Dominican Republic, Costa Rica, Germany and the Netherlands. Costa Rica, while nominal compared to the proposed tariff on China, has become a MedTech hub for many of the pure-play medical device companies and a 10% tariff considering the volume is hardly non-impactful. However, the more obvious conclusion is that any permanent tariff increase levied on China is going to have material impacts on the industry as a whole, and ripple to healthcare costs.

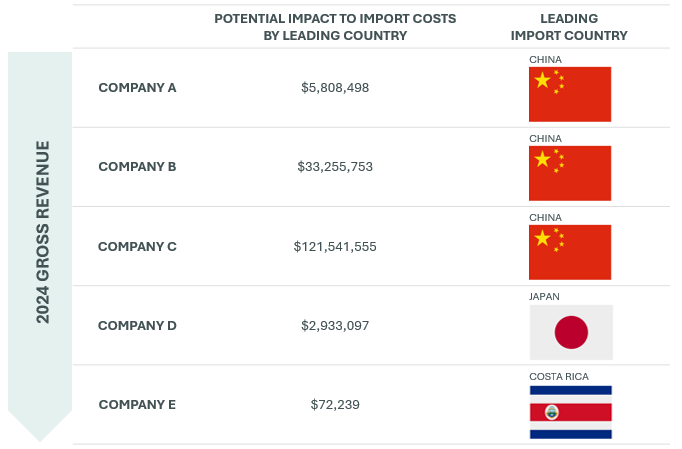

Potential Cost Impact on the Top 20 Pure Play Medical Device Companies

From the top 20 medical device companies, five were selected to delve deeper into the cost elevation they are at risk of as an organization. For some, the impact is nominal, but for others it’s material and begs additional questions on how this impact will be accounted for, and what mitigation tactics can be put in place to lessen the blow.

To reiterate, the proposed tariffs by the Trump Administration are evolving continuously, as is their theoretical impact on the Medical Device industry.

We will continue to monitor and explore the impact of these tariffs, focusing next on the lines of business within these companies most at risk based on what is manufactured where. Our goal is to remain a resource to those in this industry, sharing trends, expertise, mitigation opportunities and leverage CBRE’s subject matter experts as established supply chains are forced to be reimagined.

For More Information

| CBRE has assisted clients globally with real estate portfolio strategies to meet each company’s bespoke business goals. If you’d like to learn more about CBRE’s Medical Device Community of Practice, how we service multinational portfolios and transactions, or simply trends were seeing in the industry, please contact us at: |

|

|

| |  | |

Scott Miller

CBRE Executive Vice President |

Jordan Adams

CBRE Senior Associate |

|

|

. .   |   . .   |

|

|

|

|

| Scott Miller and Jordan Adams are part of a six-person tenant advocacy team in the Philadelphia region and specialize in servicing national and global MedTech manufacturing firms. Scott and Jordan help their clients accomplish their real estate goals through strategic planning and implementation. |

| |

| |

| |

Katherine

Hollingsworth

Transaction

Management |

Seth Martindale

Economic Incentives

Procurement |

Ross Huber

Financial Consulting Group |

|

|

|

| |

| |

| |

Felix Meier

Geographic Information

Systems (GIS) |

Darrell Schuler

Project Management |

Bridget Abraham

Workplace Strategy |

|

|

|

| |

| |

| |

Brian May

Energy and Power

Procurement |

Carolyn Schill

Portfolio Services |

Stephanie Greene

ESG |

|

|

|

| Additional Topics |

|

|  |

High-Impact Strategies

to Transform Your

Real Estate Portfolio |

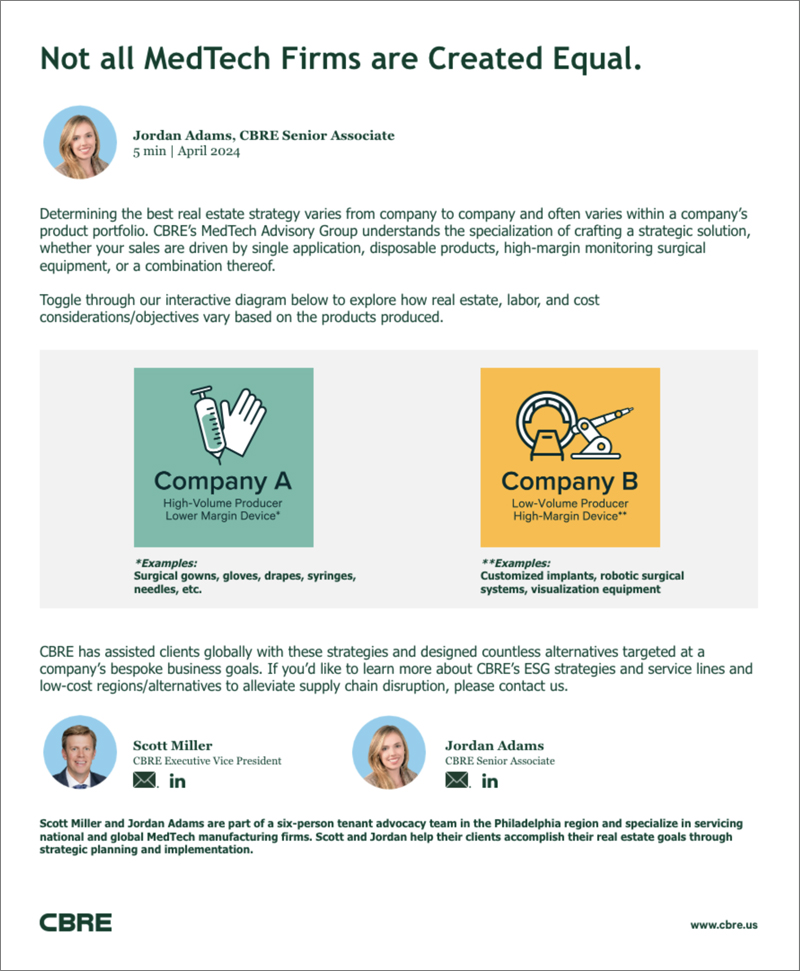

Not all MedTech Firms

are Created Equal |

|

|

|  |

| Headwinds for the MedTech and Life Sciences Labor Markets Expected to Remain Strong Through 2024 |

CBRE at the American Medical

Device Summit |

|

|

| MedTech Advisory |

|