|

|

|

|

|

With an uptick in demand fueled by the 2020 COVID-19 pandemic, Industrial Outdoor Storage (IOS) is a relatively new, hot ticket property type that has been gaining traction in Tennessee and across the U.S. While the definition of this property type varies by use and location, in its simplistic form, it is a site for outdoor storage that can accommodate everything from semi-truck to shipping containers and even temporary storage of construction materials for nearby developments. E-commerce and 3PL companies have been the most active users in this space, with IOS sites used for storing empty trucks to maintain fleet accessibility.

|

|

|

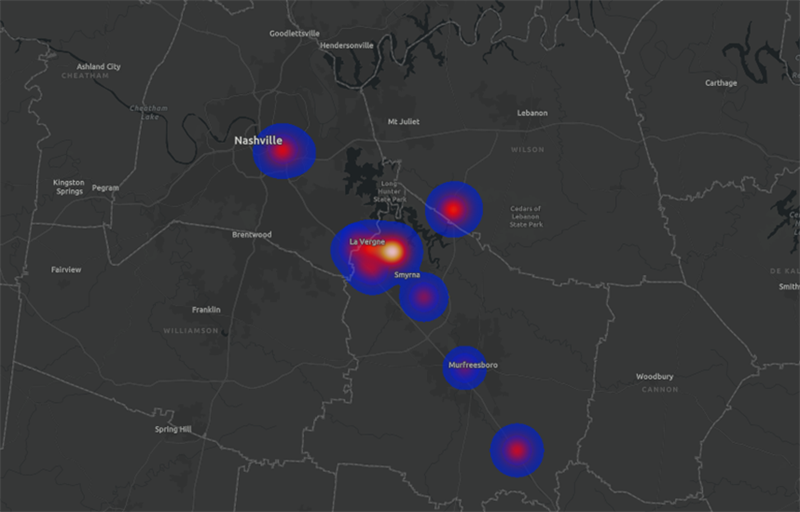

FIGURE 1: In Nashville, the I-840 corridor, one of Nashville’s most active industrial submarkets, was a hotspot for IOS transactions in 2022.

|

|

|

Source: CBRE Research, ESRI Business Analyst.

|

|

|

The low maintenance costs associated with an opportunity that has the potential to generate revenue is highly-attractive to investors — enter IOS. IOS has gained increasing popularity among investors and users; however, zoning policies are restricting land use for IOS purposes, especially in infill locations, which are becoming harder to come by. Good highway access, and ease of ingress and egress, are highly desirable locational attributes for IOS, but are increasingly challenging to find zoned for IOS-specific use.

|

|

|

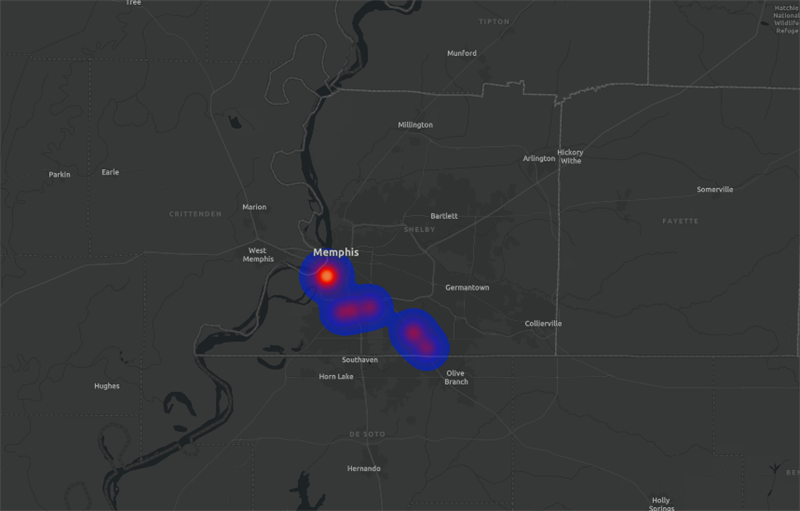

FIGURE 2: In Memphis, the Southwest submarket recorded the largest volume of IOS transactions in 2022.

|

|

|

Source: CBRE Research, ESRI Business Analyst.

|

|

|

Opportunities and Challenges with Industrial Outdoor Storage in Tennessee

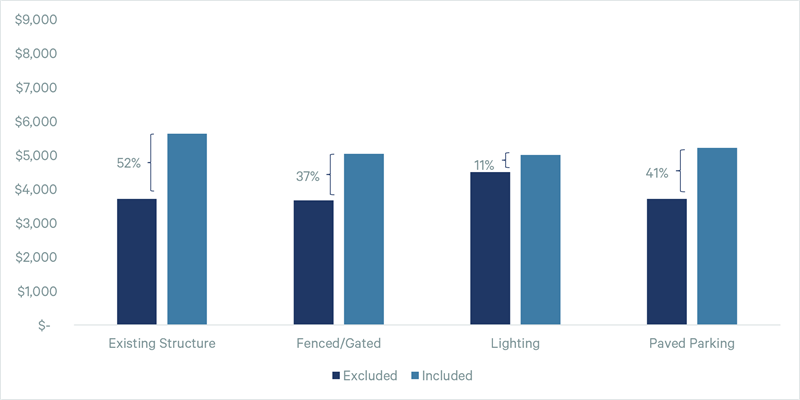

In Tennessee, the deal economics can range widely for both sale and lease transactions based on location, site amenities, and costs associated with re-zoning compliance. A site’s features, whether paved, fenced, contains lighting, or has an existing building on the property, will have varying rent premiums. Based on an analysis of 21 rental comps transacted in 2022 in Nashville and Memphis, rental rates can command an 11% to 52% premium, depending on the site features.

Furthermore, some counties in Tennessee might have requirements, such as crushed concrete as a base finish. Other jurisdictions may require additional site improvements like fencing and lighting, creating an additional cost burden to owners and increasing barriers to entry for IOS-zoned land through inflated, upfront costs.

|

|

|

FIGURE 3: IOS rental premiums by site features (acre/sf/mo)*

|

|

|

Source: CBRE Research.

*Rent premiums are based on aggregate averages for Memphis and Nashville, and rents in each market start at different price points based on location.

|

|

|

The Future of Industrial Outdoor Storage

The demand for industrial outdoor storage is strong across Tennessee; however, scarcity of land, zoning barriers to entry, and rising rental rates are providing challenges to investors and occupiers, potentially limiting growth and expansion opportunities for the product type in the near term.

|

|

|

|

|

Unsubscribe

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330). Please consider the environment before printing this email. CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166. Address: 222 2nd Ave S, Suite 1800, Nashville California 37201 © Copyright 2026. All rights reserved. This report has been prepared in good faith, based on CBRE's current anecdotal and evidence based views of the commercial real estate market. Although CBRE believes its views reflect market conditions on the date of this presentation, they are subject to significant uncertainties and contingencies, many of which are beyond CBRE's control. In addition, many of CBRE's views are opinion and/or projections based on CBRE's subjective analyses of current market circumstances. Other firms may have different opinions, projections and analyses, and actual market conditions in the future may cause CBRE's current views to later be incorrect. CBRE has no obligation to update its views herein if its opinions, projections, analyses or market circumstances later change. Nothing in this report should be construed as an indicator of the future performance of CBRE's securities or of the performance of any other company's securities. You should not purchase or sell securities-of CBRE or any other company-based on the views herein. CBRE disclaims all liability for securities purchased or sold based on information herein, and by viewing this report, you waive all claims against CBRE as well as against CBRE's affiliates, officers, directors, employees, agents, advisers and representatives arising out of the accuracy, completeness, adequacy or your use of the information herein. CBRE and the CBRE logo are service marks of CBRE, Inc. All other marks displayed on this document are the property of their respective owners, and the use of such logos does not imply any affiliation with or endorsement of CBRE. Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

|

|