| Like the hottest restaurant in town, where you just can't seem to get a table, office tenants aspire for a centrally-located seat along Philadelphia's storied Main Line, or right next to it, but can't find the space at a price they like.

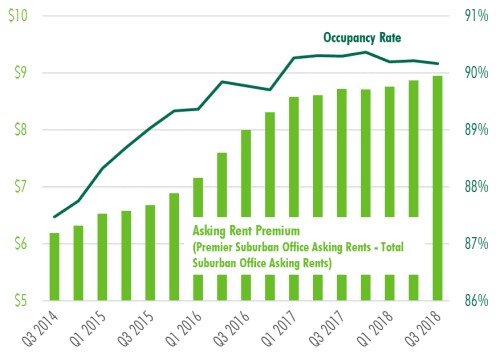

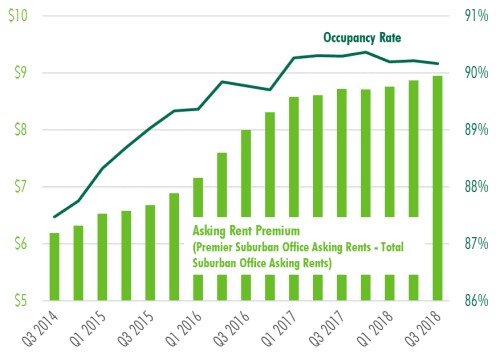

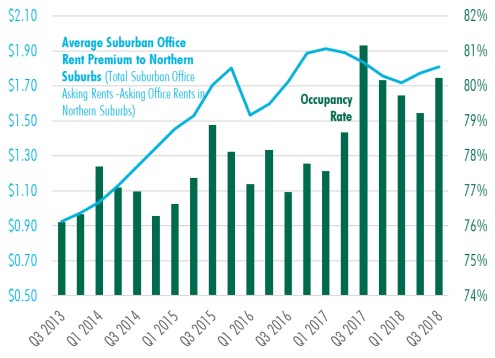

The "premier" suburban office submarkets (Main Line, Conshohocken, Bala Cynwyd) are operating at record-occupancy and asking record-rents. As figure 1 shows, the asking rent premium for these premier submarkets (the difference between asking rents in the premier submarkets and the rest of the suburban office market) continues to grow. It is a sign of the increasing disparity in the suburban office submarkets between the "haves" and "have nots."

| X |

| Figure 1: Big Premiums to be in Premier Office Submarkets |

|

| (Source: CBRE Research. Premier submarkets include Bala Cynwyd, Conshohocken, and Main Line.) |

| X |

So, companies are adjusting.

Most notably, we have observed "overflow" to adjacent locations such as East Swedesford Road in King of Prussia and Newtown Square. But the spillover from the premier submarkets is spreading farther.

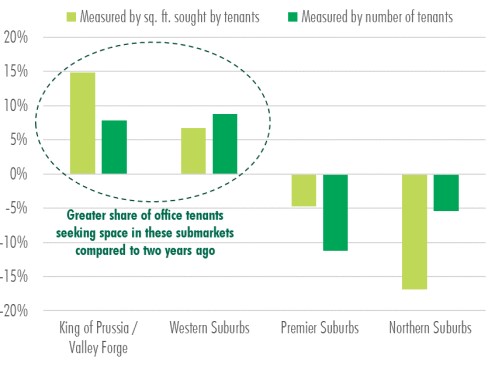

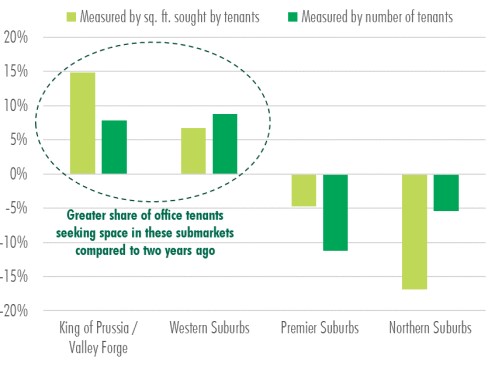

Figure 2 shows the clear shift in where tenants are seeking to locate.

In late 2016, on a square foot basis, the same share of tenants were seeking to locate in either the premier submarkets, King of Prussia/Valley Forge, or the Western Suburbs. Today, that preference has changed to a greater share of tenants seeking to locate in King of Prussia/Valley Forge and the Western Suburbs and a lesser share in the premier submarkets or the sluggish submarkets in the Northern suburbs. |

| X |

Figure 2: Suburban Office Tenants Pivot

2016-2018 Change in Share of Submarket Destination

for Tenants Seeking Office Space |

|

| (Source: CBRE Research. "Western Suburbs" include Upper Main Line, Exton/West Chester, and Delaware County submarkets; "Northern Suburbs" include Blue Bell, Central Bucks, Fort Washington. Horsham/Willow Grove, Jenkintown, Lower Bucks, North Penn, and Plymouth Meeting submarkets) |

| X |

Due to this shift in tenant preference, the King of Prussia/Valley Forge submarket has clearly experienced the greatest increase in occupancy and rents over the last year. And though a lesser share of tenants are seeking space in the premier suburban markets, there's certainly still enough to cause strong market fundamentals and rising rents.

At the same time, trends suggest that the sluggish office submarkets in the northern suburbs will benefit. There is little chance of any new office supply in any of the suburbs over the next 18 months, and office-using employment is forecast to continue growing, suggesting demand for office space will increase and vacancy rates tighten.

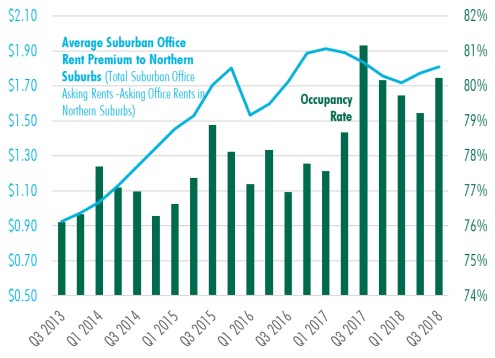

Also, as figure 3 shows, the average asking rents for the Northern Suburban office markets are as cheap, on a relative basis to the rest of the market, as they have been in years. Perhaps, as a result, occupancy has risen in these submarkets - and will continue to do so. |

| X |

Figure 3: Hope for Northern Suburban Office Submarkets?

They're Almost as Cheap as They've Ever Been - and Occupancy is Rising |

|

| (Source: CBRE Research) |

| X |

Contact:

Ian Anderson

Director of Research and Analysis

T + 1 215 561 8997

ian.anderson2@cbre.com |

|  |

|

|

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330).

Please consider the environment before printing this email.

CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166.

Address: Two Liberty Place, 50 S. 16th Street, Suite 3000 Suite 700, Philadelphia PA 19102

© 2024 CBRE Statistics contained herein may represent a different data set than that used to generate National Vacancy and Availability Index statistics published by CBRE Corporate Communications or CBRE's research and econometric forecasting unit, CBRE Econometric Advisors. Information herein has been obtained from sources believed reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the market. This information is designed exclusively for use by CBRE clients, and cannot be reproduced without prior written permission of CBRE.

CBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners.

Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

|