• The immediate area east of Houston is known for the Port of Houston, petrochemical plants, and 93 million sq. ft. of industrial warehouse and distribution space. Now, the east is experiencing explosive growth—for example, East Downtown, which is commonly referred to as “EaDo,” is transitioning from primarily an industrial warehouse district to an emerging retail hot spot, despite being east of IH-69 and downtown Houston.

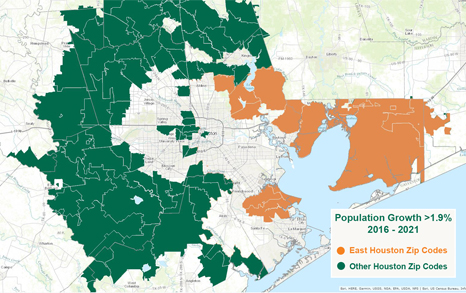

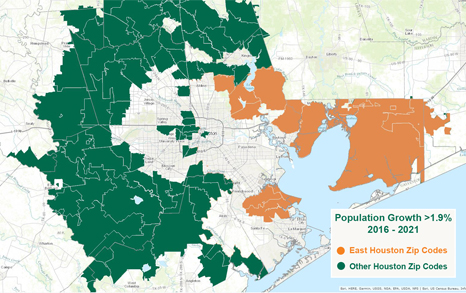

• Interestingly, East Houston population gains are on par with some west Houston suburbs. CBRE Research identified 15 eastern zip codes growing faster than the metro average, with a combined population growth rate of 2.5%, which means there is fresh opportunity for retail and residential real estate.

Large expanses of land have attracted master-planned community developers westward to Katy, Cinco Ranch, Fairfield and most recently, the Bridgelands. While known primarily for industrial uses, East Houston offers convenient access to the Port of Houston and Bush Intercontinental Airport, as well as a shorter commute to downtown. A healthy downstream petrochemical industry, which is predominantly clustered in East Houston, has spurred $60 billion in petrochemical development projects. This influx of capital and attention to East Houston is fundamentally transforming the way residents and developers perceive the east side.

Projected population growth above Houston metro average (>1.9%)

Source: U.S. Census Bureau, March 2017.

Population creeps eastward

A clustering of recent population gains is visible in the far reaches of the Houston MSA, mirroring the newly constructed expansion of the Grand Parkway and growth within associated master-planned communities. However, a look at the eastern half of Houston shows a similar population growth rate of 2.5% in 15 zip codes throughout east, southeast, and Port of Houston communities. According to forecasts from the Bureau of Labor Statistics, these communities will add 60,400 residents by 2021, with the strongest growth anticipated along the East Beltway near Sheldon and Summerwood.

Industrial demand dominated Southeast investment dollars

Industrial demand continues to play a prominent role in commercial investment in East Houston. Tens of thousands of acres of previously unimproved land are currently being rapidly developed and marketed with extensive infrastructure and structural investment. Aggressive expansions in rail, barge, and highway service in the Southeast region is rapidly positioning the area’s economy to capitalize on heavy logistics demand for both consumer products and downstream petrochemical users. The development of these mega-parks is a transformative asset to the area’s economic growth, and provides a valuable revenue source for the surrounding metro.

Retail and rooftops replacing coastal plains

Retailers are increasingly taking note of the expanding demographics on the east side. A new H-E-B anchored shopping center is underway in Baytown in addition to the new Kroger in Baytown, which was recently completed. Multifamily developers have also been active in East Houston during this construction cycle, adding new product to a predominantly older complex inventory. Greystar opened Ravella at Eastpoint, a 283-unit apartment complex, last year across IH-10 from San Jacinto Mall, which is also undergoing a large renovation project.

As Houston’s population continues to grow, the east side is poised to capture an increasing share of attention from developers and business due to favorable demographics, economic development and infrastructure expansion.

Robert Kramp

Director of Research and Analysis - Texas-Oklahoma-Arkansas Region

T 713 577 1715

robert.kramp@cbre.com