|

•

•

|

The Texas Medical Center (TMC) in Houston is a primary contributor to the regional and state economy, providing more than $14 billion annually in Lone Star economic impact. In addition to the balance sheet tangibles, the TMC positions Houston as one of the world leaders in healthcare, pharmaceuticals, education and biosciences R&D for innovation and advancement in the life sciences.

This means that change is an industry-wide constant —and it boils down to the shifting use of real estate and space needs. CBRE Research analyzed how an evolving regulatory environment, in tandem with an ongoing trend toward a consumer-driven care model (i.e., the expanding urgent care concept), are driving transformation within the medical office building sector. |

|

Houston: We have a medical campus expansion boom. And that’s no problem.

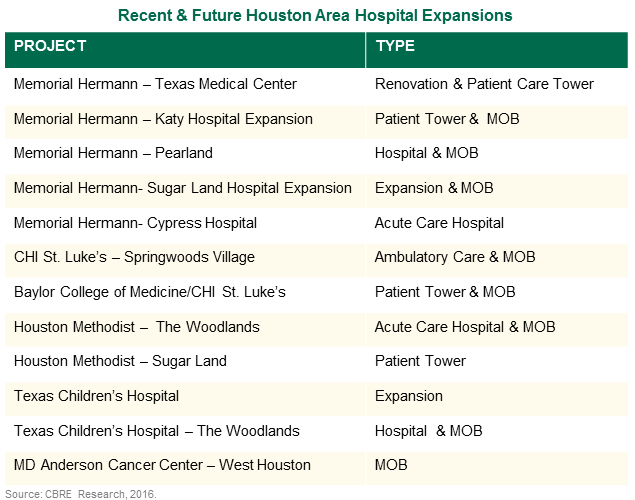

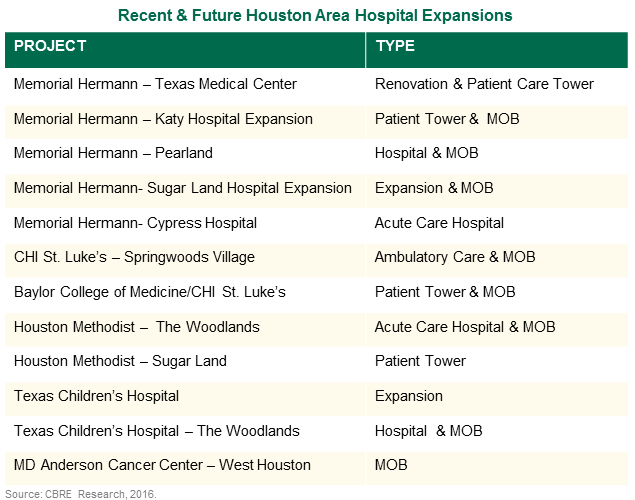

As landlocked hospitals in the TMC continue to expand in an effort to serve a geographically multiplying metro region, all of the major hospital systems are targeting the outlying Houston suburbs for new medical campuses. Combined, this growth represents an enormous capital investment of approximately $5 billion into the Houston economic engine.

The Houston metro area’s strong population growth over the last five years has been in its farthest suburban neighborhoods where land is abundant. Residential counts have soared in master-planned communities such as Cinco Ranch, Cypress/Fairfield and communities in Fort Bend County, each increasing by 14% or more between 2010 through 2015. This suburban population boom earmarked the areas for healthcare expansions in order to make treatment more available and convenient for a growing number of patients. The driving distance between Cypress and the TMC is about 40 miles, and can take over an hour. This means that demand for on-campus and campus-adjacent medical office buildings (professional physician buildings leased for medical uses like general practice, specialists and dental) is growing. Meanwhile, changes in the regulatory environment have created woes for small, privately owned providers. Consolidations from these properties will continue to drive demand for MOB space throughout Houston.

CBRE Research launches new medical office building (MOB) analysis.

In a city with a substantial focus on healthcare, medical research and biotech, the medical office sector is a vital (pardon the pun) indicator of the health of commercial real estate in the overall Greater Houston economy but has gone largely untracked for a long period of time as a sector itself. To fill this void, CBRE Research is adding detailed MOB coverage and in the next installment of our healthcare-focused Market Pulse series we will analyze employment trends within the healthcare sector and what it means for growth in the Texas-Oklahoma region.

|

|  |

|

|

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330).

Please consider the environment before printing this email.

CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166.

Address: 700 Louisiana, Suite 2700 Suite 700, Houston TX 75201

© 2025 CBRE Statistics contained herein may represent a different data set than that used to generate National Vacancy and Availability Index statistics published by CBRE Corporate Communications or CBRE's research and econometric forecasting unit, CBRE Econometric Advisors. Information herein has been obtained from sources believed reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the market. This information is designed exclusively for use by CBRE clients, and cannot be reproduced without prior written permission of CBRE.

CBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners.

Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

|