|

|

|

|

1st American World Heritage City. #1 City for Millennials. Top 10 Food Cities. Rate of Philly Job Growth Outpacing that of New York City. #4 American Metro for New Retail Entrants.¹ |

|

|

|

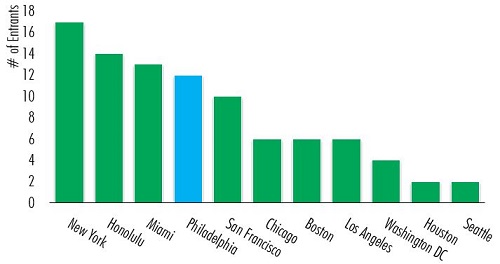

The recent rankings and headlines don’t lie: Greater Philadelphia has been steadily building a considerable new allure for residents, tourists, and workers, and increasingly, for the retailers that serve them. After adding a modest, but rising, number of new retailers over the past few years, the region made a splash in 2016 by welcoming 12 retailers new to the market, a record number of which landed Philadelphia a ranking in the top 5 metros nationally for new retail entrants, beating out San Francisco to attain the #4 spot. Among the global and national retailers fresh to the market were Italian furniture company Natuzzi Italia, German cosmetics shop Kneipp, luxury brands Diane von Furstenberg, Jimmy Choo and MCM, and mid-range fashion retailers such as Rag & Bone, COS, Superdry and Under Armour Brand House.

Figure 1: Number of Established Retailers New to Market in 2016 by US Metro

|

|

Source: CBRE Research, 2017.

Within Greater Philadelphia, two main hotspots have worked in concert to bring greater retailer attention to the region: Philadelphia’s Center City and King of Prussia. Because of its growing dynamism as a place to live, work, and play, Center City has become not just an attractive place for retailers to plant a first flag in the greater region, but also a popular test market for new retail concepts, such as Warby Parker, and urban formats for Target and A.C. Moore, as well as a target site for flagship stores, which Old Navy, Verizon and Whole Foods opened in 2016.

King of Prussia, a suburb of Philadelphia, is anchored by its renowned mall, which not only is the biggest mall in the country by retail sq. ft. but is also demonstrably attuned to shifting consumer preferences and, thus, keeps evolving and expanding. In 2016, as some other area malls declined or shuttered, the King of Prussia Mall completed a 155,000 sq. ft. expansion to house 50 new tenants, half of which are mid-range to luxury brands, and to deliver superior shopping experience. The success of these two areas in attracting both established and new-to-market retail tenants has elevated the reputation of the entire Greater Philadelphia market.

|

Figure 2: Retailers New to the Greater Philadelphia Market in 2016

|

|

Source: CBRE Research, 2017.

Looking forward, Greater Philadelphia’s status as a destination for retailers will shine even brighter now that it has made such a bold entry into the global retail conversation. So far in 2017, multiple new national and international retailers have opened up their first location in the Philadelphia market, such as Clarins, Bottega Veneta and Legoland Discovery Center, and CBRE Research is tracking more new-to-market retail tenants to come.

Contact:

Lisa DeNight

Senior Research Analyst

T + 1 215 561 8932

lisa.denight@cbre.com

Wei Luo

Research Analyst

T +1 215 5618924

wei.luo@cbre.com

¹Sources, in order: Organization of World Heritage Cities, 2016; Adobo, 2016; Washington Post, 2016; Ian Anderson, CBRE Research, 2017; CBRE Research, 2017.

|

|  |

|

|

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330).

Please consider the environment before printing this email.

CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166.

Address: Two Liberty Place, 50 S. 16th Street, Suite 3000 Suite 700, Philadelphia PA 19102

© 2025 CBRE Statistics contained herein may represent a different data set than that used to generate National Vacancy and Availability Index statistics published by CBRE Corporate Communications or CBRE's research and econometric forecasting unit, CBRE Econometric Advisors. Information herein has been obtained from sources believed reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the market. This information is designed exclusively for use by CBRE clients, and cannot be reproduced without prior written permission of CBRE.

CBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners.

Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

|