|

|

|

|

|

|

|

| SOUTHERN CALIFORNIA MARKETFLASH |  |

|

|

|

|

|

|

|

| Life in the Fast Lane: The Pandemic Has Made Drive-Through Retail More Relevant Than Ever |

|

|

|

|

|

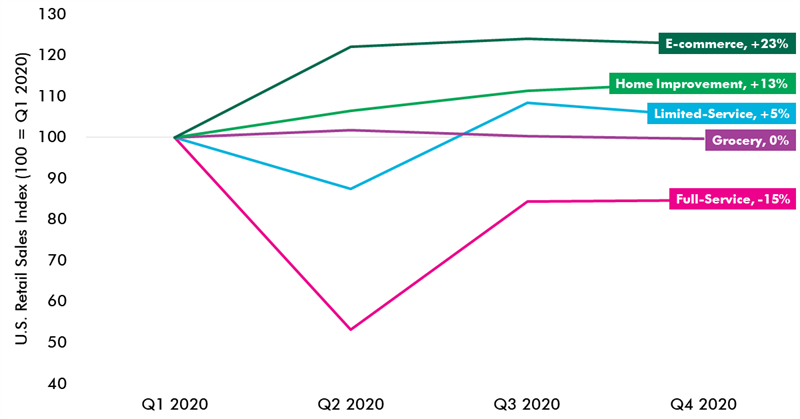

| U.S. sales revenue from limited service restaurants, including drive-throughs, increased 5% from Q1 2020, while full-service restaurant sales dropped 15% in the same period due to social distancing guidelines. |

|

| Source: U.S. Department of Commerce - Bureau of Economic Analysis (BEA); CBRE Research, 2021. |

|  |

|

|

|

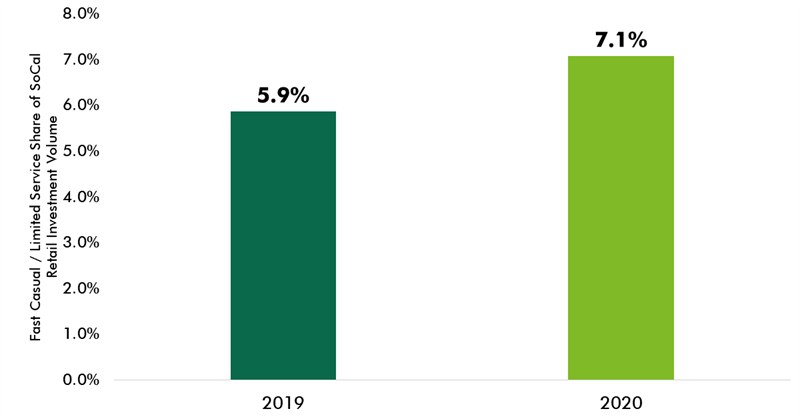

| Freestanding retail buildings, especially those with drive-throughs, captured an increased share of the SoCal investment activity in 2020 due to their ability to house tenants that have been relatively unimpeded by the pandemic. |

|

| Source: Real Capital Analytics (RCA); CoStar; CBRE Research, 2021. |

|  |

|

|

|

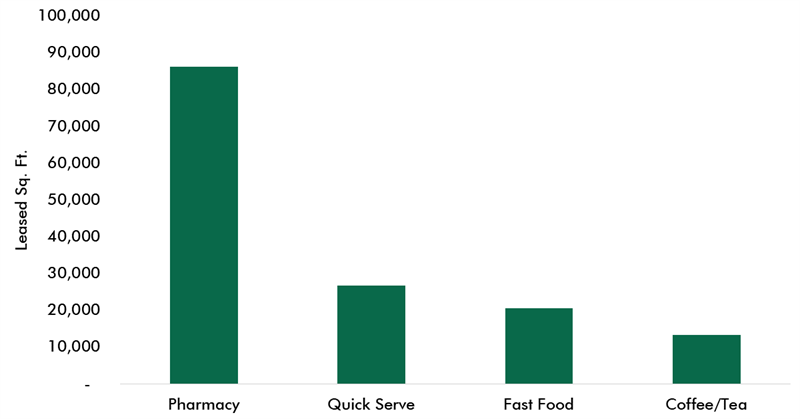

| Over 147,000 square feet of retail space was leased from drive-through pharmacies, quick-serve, fast food, and drinking places throughout the SoCal region in the last twelve months. |

|

| Source: CoStar; CBRE Research, 2021. |

|  |

|

|

|

Engage your clients and colleagues directly by sharing this report via your social network. |

|  |

|

|

|

|

|

|

|

|

Unsubscribe

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330). Please consider the environment before printing this email. CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166. Address: 400 South Hope Street, 25th Floor Suite 700, Los Angeles CA 90071 © 2026 CBRE Statistics contained herein may represent a different data set than that used to generate National Vacancy and Availability Index statistics published by CBRE Corporate Communications or CBRE's research and econometric forecasting unit, CBRE Econometric Advisors. Information herein has been obtained from sources believed reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the market. This information is designed exclusively for use by CBRE clients, and cannot be reproduced without prior written permission of CBRE. CBRE and the CBRE logo are service marks of CBRE, Inc. All other marks displayed on this document are the property of their respective owners, and the use of such logos does not imply any affiliation with or endorsement of CBRE. Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

All of CBRE's COVID-19 related materials have been developed with information from the World Health Organization, the Centers for Disease Control & Prevention (and similar global organizations), public health experts, industrial hygienists, and global subject matter experts across CBRE and our strategic suppliers. Our materials may not be suitable for application to all facilities or situations.

Ultimately, occupiers and landlords must make and implement their own reopening decisions for their individual stakeholders and facilities. CBRE's guidance is intended to help facilitate those discussions and expedite the implementation of those decisions once made by the client. We make no representations or warranties regarding the accuracy or completeness of these materials. CBRE cannot ensure safety and disclaims all liability arising from use of these materials.

|

|

|

|