|

|

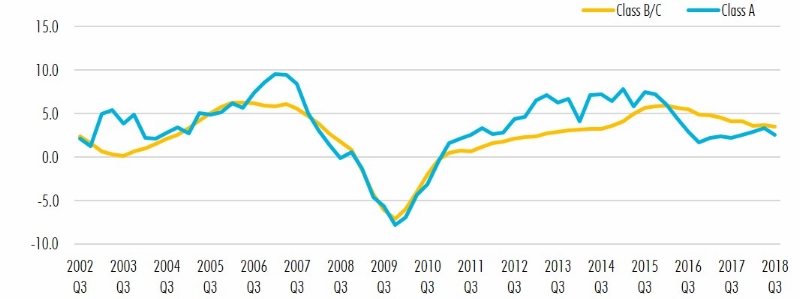

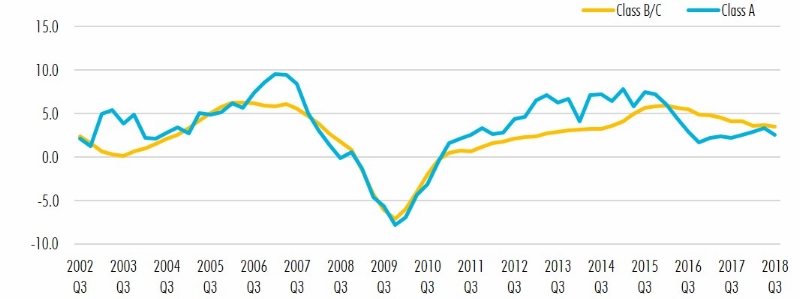

For much of the recovery, investors enjoyed strong gains from solid rent growth across the higher-end apartment market. In Los Angeles, Class A apartment rents climbed 41.4% since 2010. As the cycle matured, the market became saturated with Class A apartments and yields on expensive dwellings were squeezed to historic lows, slowing down the pace of year-over-year rent growth to a tepid 2.5% in Q3 2018 (Figure 1). Smaller gains in the high-end space, coupled with a lack of affordable housing, shifted investor attention to older, less expensive Class B and Class C apartments* (“workforce housing”) where rent growth surged in 2015 and has been outperforming Class A product since. In Q3 2018, workforce housing rents increased 3.5% year over year.

Fig. 1: Luxury vs. Workforce Housing Rent Growth in Los Angeles, Year Over Year (%)

Source: CBRE Research, Q4 2018. |

|

|

Multifamily workforce housing comprises mostly older (pre-2000s product) and mostly suburban garden-style communities. Renters in these communities are often “renters by necessity” vs. “renters by choice.” Limited wage growth during this economic cycle has fed more renters into workforce housing, which has an inventory of about 928,000 units** Los Angeles.

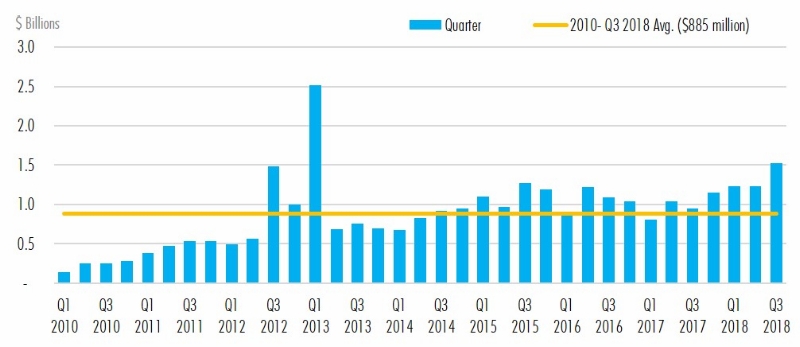

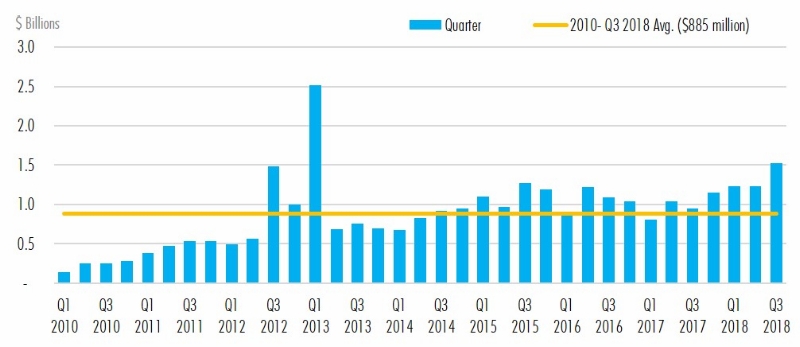

As value-add investment and redevelopment activity has increased rents in this sector, investors have stepped up transaction volume. Investors spent $1.5 billion on workforce housing in Los Angeles in the third quarter of this year. Year to date (through Q3), that figure totaled almost $4.0 billion, a 43% increase from the same time one year ago (Figure 2).

Fig. 2: Investment in Los Angeles Garden Properties (pre-2003, $ Billions)

Source: CBRE Research, Q4 2018. |

|

|

NCREIF returns for garden multifamily, a key component of workforce housing, were considerably higher than the all multifamily average. The Q3 one-year returns for garden assets in Los Angeles averaged 10.5%, nearly double the overall multifamily return of 6.6% (Figure 3). Workforce housing has been outperforming the broader multifamily market since 2015 and should continue

that trend for the near term since this sector’s superior performance makes it a compelling argument for investment.

Fig. 3: NCREIF Returns – Los Angeles Multifamily Total vs. Garden-Style Apartments (%)

Source: CBRE Research, Q4 2018.

*Some Class B properties would not qualify, but using classes is a frequent and adequate approach.

**Class B and C, built before 2001. |

|

|

|

|  |

|

|

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330).

Please consider the environment before printing this email.

CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166.

Address: 3501 Jamboree Road, Suite 100 Suite 700, Newport Beach CA 92660

© 2025 CBRE Statistics contained herein may represent a different data set than that used to generate National Vacancy and Availability Index statistics published by CBRE Corporate Communications or CBRE's research and econometric forecasting unit, CBRE Econometric Advisors. Information herein has been obtained from sources believed reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the market. This information is designed exclusively for use by CBRE clients, and cannot be reproduced without prior written permission of CBRE.

CBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners.

Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

|