• Globally, a projected 1.2 million members will office out of 13,800 co-working spaces (according to Deskmag) by October 2017; that’s just under the number of McDonald’s locations in the United States.

• The shared workspace concept continues to grow rapidly across the plains of Texas. While the major co-working markets within the state are at varying stages of maturation, demand is the one thing they all have in common.

At a glance: Texas markets vary across co-working growth cycle

Source: CBRE Research, Q1 2017.

The nationals are now local

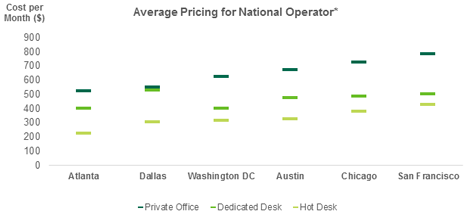

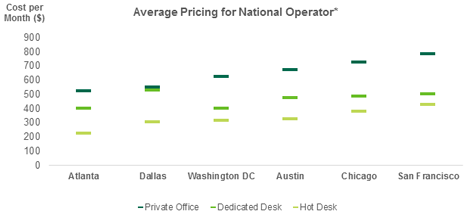

Downtown Austin was the pioneer market in Texas to welcome national co-working space operators but it is certainly not the last to do so. Even though Austin is in the mature stage of this work concept’s growth cycle, there are still growth opportunities in other markets. San Francisco, for example, is an established co-working market that has nine locations established by a leading national operator (Austin has three from the same brand). Up north, Dallas said “howdy” to its first wave of national operators in 2016, which announced plans to open more locations in 2017. One of these groups, SPACES by Regus, opened in October and is now 80% leased. Serendipity Labs has also announced plans to open nine locations in DFW, with the first scheduled to open this year. A leading national operator has leased 165,000 sq. ft. between three locations in the Dallas CBD, Uptown, and Legacy submarkets. Meanwhile, Houston expects TechSpace, the market’s first national co-working operator, to open its doors this spring in the Westchase District; other early adapters are anticipated to follow suit later this year.

Coming to an office near you: co-working by way of "landlord ownership"

A new form of co-working competition has emerged: landlord ownership, or simply put, co-working as a building amenity. For some office properties, co-working is achieved by renovating its lobby or common area; it is considered a capital improvement and is woven into the building’s operating expenses. Adding amenities such as free WiFi, couches and bartop seating are several enhancements a building owner can incorporate into lobby areas to improve the tenant experience. Others are taking it a step further by converting empty or unused office space into co-working facilities as an added amenity. This landlord-driven approach toward the shared workspace culture is occurring in the Dallas, Houston and Austin CBDs, but also in the suburban areas of Plano (north of Dallas) and within the Galleria submarket in Houston.

Not just for entrepreneurs and start-ups anymore

Corporate co-working has become a growing trend as companies recognize that “one size fits all” office space is not feasible. Companies are creating more open/collaborative/co-working spaces within a larger footprint; or they hire a third party co-working operator to run this amenity. Other companies purchase co-working memberships for portions of their workforce. In the third scenario, the company still operates predominately out of traditional office space and provide their mobile workforce access to additional co-working locations. The co-working operator benefits because corporate memberships will typically take a longer term (i.e., three years vs. 12 months) than a smaller lessee of a co-working office.

At a glance: Texas markets vary across co-working growth cycle

Source: CBRE Research, Q1 2017.

*Prices based on a leading national operator; does not include membership fee

Robert Kramp

Director of Research and Analysis - Texas-Oklahoma-Arkansas Region

T 713 577 1715

robert.kramp@cbre.com