|

INTEREST RATE UPDATES, PROJECTIONS & LENDING NEWS | DECEMBER 2014 |

|  |

|

Team Members Team Members |

Jason Hochman

Vice President

Debt & Structured Finance

T: +1 305 381 6439

jason.hochman@cbre.com

Website

Resume

Steven Okon

Senior Financial Analyst

T: +1 561 393 1618

steven.okon@cbre.com

Website

Heidi Peckhaus

Client Services Coordinator

T: +1 561 393 1670

heidi.peckhaus@cbre.com

Website

________________________

Local Offices:

CBRE Capital Markets

DSF | Miami Office

777 Brickell Ave., Suite 900

Miami, Florida 33131

T +1 305 381 6439

F +1 305 381 6462

CBRE Capital Markets

DSF | Boca Raton Office

5100 Town Center, Suite 600

Boca Raton, Florida 33486

T +1 561 393 1614

F +1 561 393 8122

________________________

CBRE, Inc.

Licensed Real Estate Broker

|

|

Learn more about our team!

© 2014 CBRE Information contained herein, including projections, has been obtained from sources believed to be reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to confirm independently its accuracy and completeness.

Click here for access to the printable version online Click here for access to the printable version online | |

|  |

From the desk of Jason Hochman From the desk of Jason Hochman | Volatility – Over the last month we’ve seen interest rates fall and rise with significant day-to-day movement. The 10 year treasury was about 2.35% in mid-November, fell as low as 2.06% and has risen in the last few days to about 2.20% today. Both domestic and foreign issues have impacted this volatility including the falling price of oil, economic troubles in Europe and Asia (especially in Russia), the absence of inflation in the developed world and additional tension with North Korea. While the Fed declared this week that it would be “patient” in deciding whether to raise rates, some experts are predicting increases as early as this spring.

In the meantime, lending rates for commercial properties remain very low. Lender spreads have widened a bit this month as treasuries have declined (partially due to issues mentioned above), but borrowing rates are still at or below where they were last month. No one knows how long this historic opportunity will continue, so many investors are trying to lock in rates today.

If you are evaluating an acquisition, have a loan maturing over the next year or can pre-pay an existing loan without much penalty, feel free to contact us to evaluate the various opportunities available including those mentioned below.

|

|

|

|

|

Property Types |

Loan Types |

Features |

|

|

|

|

|

• Multi-Family/Apts.

• Office

• Industrial

• Retail

• Hospitality/Hotels |

• Permanent

- Life companies

- Conduit (CMBS)

- Banks

• Bridge Loans |

• Non-recourse (no guaranties)

• Flexible Prepayment

• Fixed Low Rates

• Amortization Options

including interest only |

|

|

|

|

|

|

• Mezzanine Loans |

|

|

|

|

|

|

|

• Construction/

Development |

|

Interest Rate Analysis Interest Rate Analysis

|

|

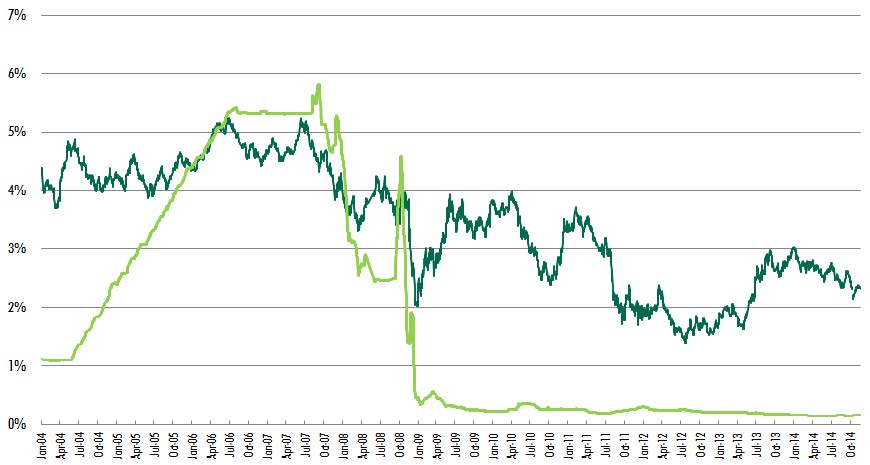

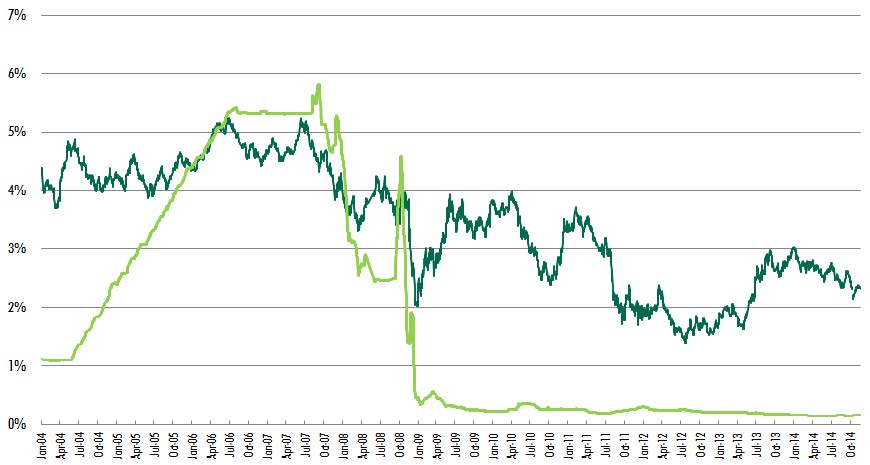

Prime |

5-Yr T |

10-Yr T |

1-M Libor |

DJ Avg. |

| 12/18/14 |

3.25% |

1.66% |

2.21% |

0.16% |

17,778 |

| 11/18/14 |

3.25% |

1.60% |

2.32% |

0.15% |

17,688 |

| Year Ago |

3.25% |

1.53% |

2.88% |

0.17% |

16,163 |

|

Interest Rate Projections* |

|

4Q 14 |

1Q 15 |

2Q 15 |

3Q 15 |

4Q 15 |

| 10-Y Avg. |

2.52% |

2.72% |

2.90% |

3.09% |

3.23% |

| Fed Fund |

0.25% |

0.25% |

0.25% |

0.25% |

0.34% |

| 1-M Libor |

0.16% |

0.17% |

0.23% |

0.43% |

0.65% |

*Bloomberg Monthly News 11/13/14, *Chatham Financial 11/24/14

|

Average 10-Year Treasury vs. 30-day LIBOR |

Market Briefs

| • |

Commercial and multifamily mortgage loan originations increased 18% in the third quarter compared to the second quarter and were 16% higher compared to the third quarter of 2013, according to the Mortgage Bankers Association's (MBA) quarterly Commercial/ Multifamily Mortgage Originations report.

|

|

• |

RCA reported that sales of significant commercial property totaled $37.6 billion in October, up 3% YOY, with the retail sector recording the most robust volume gains. Cap rates declined between 5-10 bps across most property types.

|

| • |

Not to toot our own horn (but we will), according to the CREF forecasts, CBRE will out-perform the market with an estimated 16% YOY origination growth compared to the overall market growth of 6% YOY for 2014.

|

Featured Transaction Featured Transaction

|

International Park and Blue Lake Center properties span 377,921 square feet of Class A office space in one of Birmingham’s most sought-after submarkets, the 280/459 corridor, and were acquired for $51 million. The transaction closed in the last quarter of 2014 with non-recourse financing from a CMBS lender in the amount of $41 million at a fixed rate with a 10-year term.

Recently Closed Deals Recently Closed Deals

|

| Deal |

Asset Type |

SF |

Financing |

Loan Type |

|

Flagler West Corporate Park

Miami, Florida |

Office |

126,004 |

$20,750,000 |

CMBS/Mezzanine |

Metrocentre Corporate Center

West Palm Beach, Florida |

Office |

105,159 SF |

$7,000,000 |

Bridge Loan |

|

Intl Park & Blue Lake Center

Birmingham, Alabama |

Office |

377,921 |

$41,190,000 |

CMBS |

|

Oakland Park Industrial Center

Oakland Park, Florida |

Industrial |

145,260 |

$6,100,000 |

CMBS |

|

Congress Office Park

Delray Beach, Florida |

Office |

53,843 |

$5,500,000 |

Life Company |

|

Jupiter Medical & Tech Park

Jupiter, Florida |

Medical/Office |

185,000 |

$27,000,000 |

Bridge Loan |

AT&T Regional Training Center

Fort Lauderdale, Florida |

Flex/Industrial |

79,412 |

$4,900,000 |

Bridge Loan |

Brandywine Centre I

West Palm Beach, Florida |

Office |

69,715 |

$5,039,000 |

Bridge Loan |

Cascade Apartments

Palm Beach Shores, Florida |

Multi-Housing |

11 Units |

$650,000 |

Bank/Permanent |

Wells Fargo

Delray Beach, Florida |

Office |

15,890 |

$1,775,000 |

Bank/Owner-Occupied |

Market News Market News

|

Kroll Bond Rating Agency Releases 2015 CMBS Outlook

marketwatch.com -- Kroll Bond Rating Agency (KBRA) today released a report summarizing its views for the CMBS Industry in 2015. The economy, coupled with low interest rates, contributed to continued growth in the commercial real estate and securitization markets. Property fundamentals for most CRE segments improved, fueling the appetite for CMBS investment . .. ARTICLE CONTINUED

Financial Solutions Financial Solutions |

Our team provides “institutional” quality service to South Florida’s private real estate investors. Clients enjoy our experience, lender contacts and ingenuity in creating solutions for their financing needs. We place our clients first and provide personalized service to ensure they get the best loan terms for their investments.

This is a good time to lock in a long-term, low interest rate loan without personal guaranties (non-recourse). Please click here to see additional reasons I can best assist you and add value to your real estate investment needs.

|

|

|

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330). Please consider the environment before printing this email. CBRE respects your privacy. A copy of our Privacy Policy is available online. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 17-19 Floors, New York, NY 10166. Address: 777 Brickell Ave., Ste. 900 Suite 700, Miami FL 33131 THIS IS A MARKETING COMMUNICATION© 2025 CBRE, Inc. This information has been obtained from sources believed reliable. We have not verified it and make no guarantee, warranty or representation about it. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the property. You and your advisors should conduct a careful, independent investigation of the property to determine to your satisfaction the suitability of the property for your needs. Licensed Real Estate BrokerCBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners. Photos herein are the property of their respective owners and use of these images without the express written consent of the owner is prohibited.

|  |