| OVERALL VC TRENDS

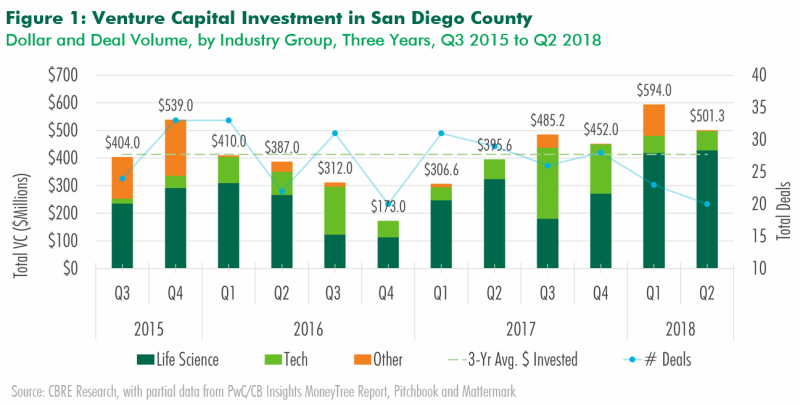

- Life science companies in San Diego received a record-setting amount of venture capital investment in Q2 2018, reaching $427.5 million, according to data from CBRE Research, PwC/CB Insights MoneyTree Report, Pitchbook and Mattermark. Investment in tech and other sectors was slower in Q2, but total investment reached $501.3 million. This was the 3rd highest quarter on record and on the heels of the record $593 million set last quarter. This amounts to a first-half pace of more than $1 billion, a mark previously not reached in San Diego.

- The global trend of higher M&A activity in San Diego slowed in terms of deal count to 16 known M&A deals in Q2, which includes announced or completed deals involving San Diego companies, but plenty of significant deals are awaiting approval. Qualcomm made international headlines after Broadcom attempted and failed to acquire the iconic San Diego company, but Qualcomm’s own proposed $44 billion acquisition of NXP Semiconductors remains in the news. The deal is awaiting approval from China, who is the final holdout of nine global regulatory bodies tasked with reviewing the deal (via CNBC).

INDUSTRY HIGHLIGHTS

- The largest deal this quarter went to Ansun BioPharma, a Torrey Pines-based clinical-stage biopharmaceuticals company that received $85.0 million in Series A funding. The announcement noted that the proceeds would be used to fund a clinical trial of the company’s experimental anti-viral medication that treats immunocompromised patients infected with parainfluenza (via PR Newswire).

- The seven largest deals overall were in biotech / pharmaceuticals. Metacrine received $65.0 million in a Series C round to advance its pipeline of metabolic drugs. The company has now raised $125 million since its founding less than three years ago that included a former Salk Institute researcher (via SDBJ). Other notable biotech / pharma deals include a $63.0 million Series C round to therapeutic protein developer Synthoryx (via SDBJ) and a $60.0 million Series A round to drug developer Neurana Pharmaceuticals (via SDBJ). The sole medical device deal went to Tear Film Innovations who received $8.5 million in a Series B round to advance the manufacturing of their device that treats evaporative dry eye (via FinSMEs).

- Investment in tech companies in San Diego remained slow compared to last year, with 10 deals totaling $68.3 million. The largest deal went to artificial intelligence (AI) startup Kneron, who raised $18.0 million in a Series A round. The funding was targeted to accelerate product development for the company’s “Edge AI” platform, which refers to a specific type of AI that relies on local computing power (i.e. smartphone or wearable device) to process and analyze AI, instead of relying on a connection to an external cloud-based processor (via SDBJ).

OTHER INVESTMENT

- San Diego-based genomics giant Illumina acquired fellow San Diego-based firm Edico Genome for $100 million (via Press Release). Illumina stated that the acquisition was a critical step in making genome sequencing and analysis “push-button” which will help make the technology more accessible and affordable.

- Poway-based semiconductor producer Cohu agreed to acquire rival Massachusetts-based Xcerra Corp. for $796 million after a Chinese state-backed fund was blocked by a U.S. security panel from purchasing Xcerra (via Reuters).

- San Diego-based electronic components manufacturer Pulse Electronics found itself on the other end of an acquisition after it was announced they would be acquired by Taiwan-based Yageo Corporation for $740 million (via SDBJ).

|  |

|

|

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330).

Please consider the environment before printing this email.

CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166.

Address: 4301 La Jolla Village Dr Suite 3000, San Diego CA 92122

© 2025 CBRE Statistics contained herein may represent a different data set than that used to generate National Vacancy and Availability Index statistics published by CBRE Corporate Communications or CBRE's research and econometric forecasting unit, CBRE Econometric Advisors. Information herein has been obtained from sources believed reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the market. This information is designed exclusively for use by CBRE clients, and cannot be reproduced without prior written permission of CBRE.

CBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners.

Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

|