|

|

|

|

|

| NYC Life Sciences Market Blossoms Amid Rush of Spring Funding |

|

|

|

|

| One of NYC’s budding sectors – the life sciences market – hasn’t lost a step during the pandemic era. Even in the face of a broader economic downturn, NYC’s lab tenant demand has ramped up significantly since year-end 2019, which has coincided with improvements in nearly all of the lab sector’s fundamentals.

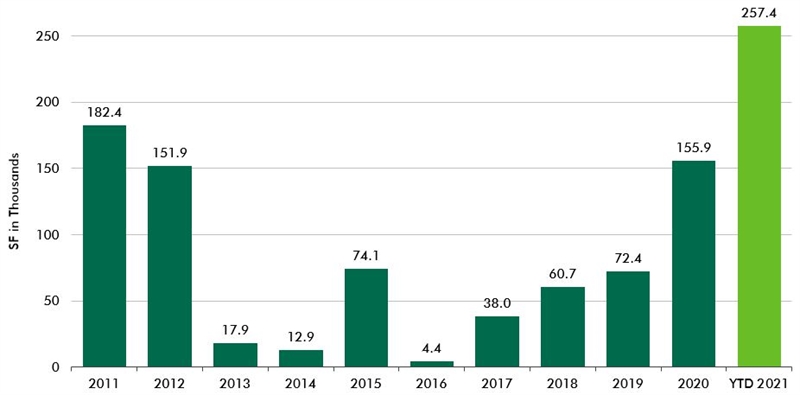

Among the milestones reached in 2020 were the first leases signed at a pair of NYC’s newest life sciences developments. Protara Therapeutics leased 10,000 sq. ft. at Cure, Deerfield Management’s redevelopment of 345 Park Avenue South into a premier life sciences hub and ecosystem. Across the East River in Long Island City, ReOpen NY completed an 18,000 sq. ft. lease at Alexandria Real Estate Equities’ redevelopment of the Bindery Building. This momentum has carried into 2021, as NYC’s lab leasing activity has already reached a record high for a single year, at 257,000 sq. ft. through May 2021. This year’s leasing activity has been bolstered by the Icahn School of Medicine at Mount Sinai’s 165,000 sq. ft. research-focused lease at 787 Eleventh Avenue and C16 Biosciences’ 19,000 sq. ft. lease at the Hudson Research Center, where the Bill Gates-backed startup will relocate from its incubator space at BioLabs New York. |  |

|

|

|

| Figure 1: NYC Life Sciences Leasing Activity |

|

New leases and expansions only.

Source: CBRE Research. Data as of June 1, 2021. |

|  |

|

|

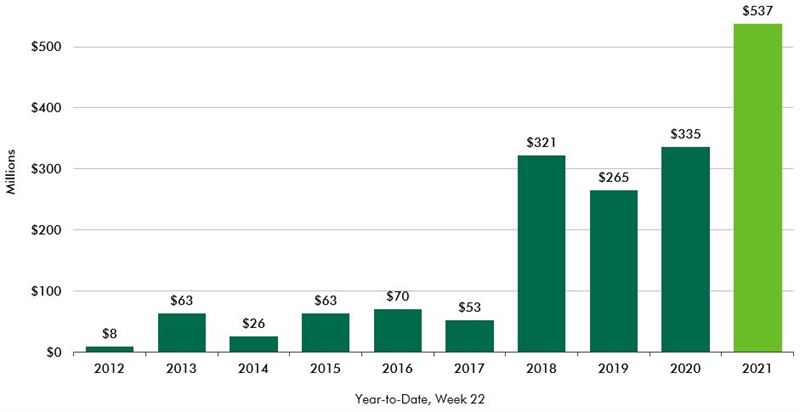

| The flow of venture capital (VC) funds into the NYC life sciences market has been one of the most telling indicators in recent years of the city’s expanding profile as a major hub for the sector. Following a record-setting 2017, which saw NYC’s life sciences funding balloon to $1.38 billion, VC funding has seen no less than $697 million raised annually, with funding reaching its second-highest total in 2020 at $942 million.

This blistering performance has only intensified further in 2021, with NYC’s life sciences VC funding off to its strongest start ever. In Q1 2021, funding amassed its highest quarterly total on record, at $393 million. And with an additional $144 million raised through roughly the first two months of Q2, 2021’s year-to-date total of $537 million is now 60% ahead of the prior high point set last year through the same time frame. |  |

|

|

|

| Figure 2: NYC Life Sciences Venture Capital |

|

| Sources: CB Insights, CBRE Research. Data as of June 1, 2021. |

|  |

|

|

| Just as important as the sheer dollar volume of VC funding over the past few years is the mix of firms that are raising the capital, with a clear link between those firms receiving VC funding and those who ultimately sign lab leases in NYC. Indeed, Hibercell, a startup born out of research at the Icahn School of Medicine at Mount Sinai – which has received multiple rounds of funding including a new round in 2021 – signed a lease in early 2019 at the Hudson Research Center. Volastra Therapeutics, which inked a lease in 2020 at the Mink Building, has also received multiple funding rounds. More recently, Immunai leased space at the Alexandria Center for Life Science in Q1 2021, after receiving funding in both 2020 and 2021. |  |

|

|

|

|

|

|

|

|

Unsubscribe

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330). Please consider the environment before printing this email. CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166. Address: 200 Park Avenue Suite 700, New York NY 10166 © 2026 CBRE Statistics contained herein may represent a different data set than that used to generate National Vacancy and Availability Index statistics published by CBRE Corporate Communications or CBRE's research and econometric forecasting unit, CBRE Econometric Advisors. Information herein has been obtained from sources believed reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the market. This information is designed exclusively for use by CBRE clients, and cannot be reproduced without prior written permission of CBRE. CBRE and the CBRE logo are service marks of CBRE, Inc. All other marks displayed on this document are the property of their respective owners, and the use of such logos does not imply any affiliation with or endorsement of CBRE. Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

All of CBRE's COVID-19 related materials have been developed with information from the World Health Organization, the Centers for Disease Control & Prevention (and similar global organizations), public health experts, industrial hygienists, and global subject matter experts across CBRE and our strategic suppliers. Our materials may not be suitable for application to all facilities or situations.

Ultimately, occupiers and landlords must make and implement their own reopening decisions for their individual stakeholders and facilities. CBRE's guidance is intended to help facilitate those discussions and expedite the implementation of those decisions once made by the client. We make no representations or warranties regarding the accuracy or completeness of these materials. CBRE cannot ensure safety and disclaims all liability arising from use of these materials.

|

|

|

|