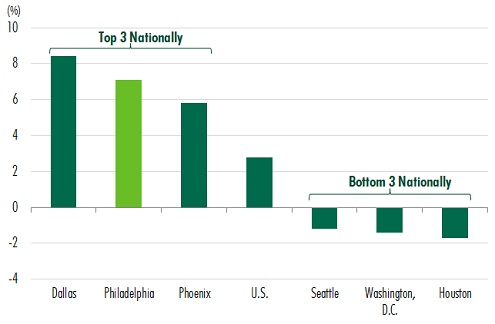

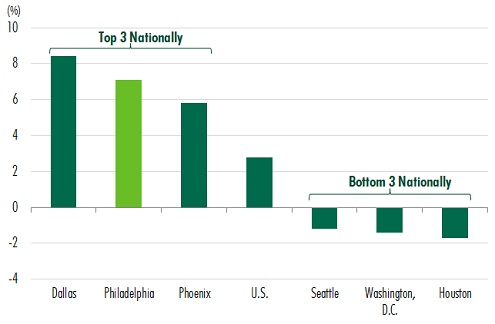

| Philly's Turn to Shine

The supply-demand imbalance in Philadelphia metro office space is making many owners, investors, and developers happy. More jobs continue to be created, and there just isn't enough attractive office space to meet current needs.

As a result, CBRE Econometric Advisors forecasts our region to experience the second-fastest increase in average rents of any major metro market in the nation over the next two years. The connection with the record-breaking pace of office building sales is not coincidental. For tenants, it should continue to prove difficult, in the near-term, to find attractive spaces at good deals.

Two-Year Office Market Rent Growth Forecast

(Avg. Annual Rates; Metro Office Markets > 50 MSF inventory; source: CBRE-EA)

WeWork opens first of three locations in Central Philadelphia; an inside peek at their NoLibs location.

Qlik of Radnor gets acquired; outlook for growth uncertain.

Occupiers already beginning to re-evaluate for 2019 new FASB standards.

Small tenants added at former Bok building in South Philly.

Talen Energy of Allentown to be acquired.

Chinese manufacturer growing rapidly in Lehigh Valley.

More warehouses planned for northern York County.

Lancaster County warehouse growing with Zika threat.

Onslaught of new supply beginning to affect NY and San Francisco multifamily markets.

$17.85 million condo at 500 Walnut breaks new pricing record.

Buccini/Pollin to assume Old City's National apartment project.

Getting a $100 per month not to drive at this multifamily project.

Just a plain bad jobs report in May.

Fed's Beige Book reports "modest growth" in Philadelphia region.

Consumer spending surges in latest report.

Bye, bye hedge funds; hello, real estate. MetLife charts new course.

NorthStar and Colony Capital to merge.

CMBS late-pays rise for a third month, but still small.

KBS to put $3.9 billion up for sale.

Q1 2016 Greater Philadelphia Retail MarketView

Q1 2016 Greater Philadelphia Industrial MarketView

Q1 2016 Greater Philadelphia Office MarketView

Wilmington's Flight to Quality

The New Landlords of the City

Dramatically Changing Suburban Office Dynamics

The Rise of the Shared Workplace in the Sharing Economy

2016 North America Seaport & Logistics Annual Report

Global & Emerging Logistics Hubs Philadelphia and the Pennsylvania Logistics Corridor featured.

Global Luxury Retail: A Divergent Market Is luxury immune to the twists and turns of the global economy?

Surging Demand for Urban Retail Groundbreaking analysis into Center City's retail market.

Beyond the Walls: How Law Firms Are Transforming Their Office Spaces

The Coworking Revolution Knowledge workers cluster in dynamic spaces

Tech Trek: A Walk Through Some of Philadelphia’s Top Tech Clusters

“Spring being a tough act to follow, God created June.”

— AL BERNSTEIN

|  |

|

|

You may also unsubscribe by calling toll-free +1 877 CBRE 330 (+1 877 227 3330).

Please consider the environment before printing this email.

CBRE respects your privacy. A copy of our Privacy Policy is available online. For California Residents, our California Privacy Notice is available here. If you have questions or concerns about our compliance with this policy, please email PrivacyAdministrator@cbre.com or write to Attn: Marketing Department, Privacy Administrator, CBRE, 200 Park Ave. 19-22 Floors, New York, NY 10166.

Address: Two Liberty Place, 50 S. 16th Street, Suite 3000 Suite 700, Philadelphia PA 19102

© 2026 CBRE Statistics contained herein may represent a different data set than that used to generate National Vacancy and Availability Index statistics published by CBRE Corporate Communications or CBRE's research and econometric forecasting unit, CBRE Econometric Advisors. Information herein has been obtained from sources believed reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the market. This information is designed exclusively for use by CBRE clients, and cannot be reproduced without prior written permission of CBRE.

CBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners.

Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited.

|

|