Dear Valued Clients and Colleagues:

What a year for commercial real estate! High prices, low cap rates and attractive financing fueled a busy year for real estate investors. The Fed finally raised interest rates—now we can all stop holding our breath in anticipation. Actually, the move was highly anticipated and the overall impact on commercial real estate was muted. Leading up to the Fed’s decision, short term financing already started adjusting lending rates and long term financing has yet to go through any significant pricing changes. The implications for 2016 and beyond are important, however. Keep a close eye on treasury rates and spreads. The availability of financing in the coming year will have a serious impact on CMBS loans set to mature in ’16 and ’17. Commercial real estate is showing signs of stabilization and the following newsletter highlights some of the interesting trends to watch in the coming years.

Capital Market Overall Trends

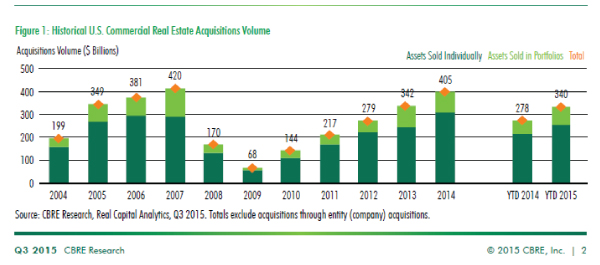

Acquisitions are starting to slow down quarter to quarter, but investment was strong closing out 2015 at approximately $109 billion. International investment continues to be a driver for demand, representing 14% of all U.S. acquisitions ending Q3 2015. International investment is focused on major markets but the influence of major market pricing is starting to push domestic investors towards secondary and tertiary markets as they hunt for better returns. As expected, agencies and life companies pulled back financing towards the end of 2015 coinciding with allocation constraints, but other factors contributing to the decline in property acquisitions are likely to carry into 2016. International market volatility and a strong U.S. dollar may slow down foreign investment, and widening spreads may make financing costs prohibitive for investors seeking higher leverage.

NICK SANTANGELO T +1 503 221 4821 nick.santangelo@cbre.com  SPENCER REID T +1 503 221 4827 spencer.reid@cbre.com |

|

“Wall of Maturities”

Many CMBS loans completed prior to the recession are going to mature in 2016 and 2017. There is speculation the pending Risk Retention deadline in December ’16 will pull back many of the loans in ’17 via defeasance2, but the remaining maturing ’17 loans will have difficulty refinancing without recapitalization. Commercial real estate valuations are already high compared to rent growth and as market fundamentals catch up and stabilize in ’16 and ’17 asset appreciation may not match refinancing needs for highly leveraged CMBS loans. U.S. commercial real estate prices are 16% above the 2007 peak, mostly driven by rising values in apartment buildings, but debt levels are down 16% from Q3 2008. Current underwriting standards are more conservative than 2006, and maturing CMBS loans may require more leverage to refinance than what the market can provide.

Risk Retention

The Dodd‐Frank Act will implement the final rule regarding risk retention requirements for securitization, starting December 24, 2016. In simple terms, risk retention requires sponsors of securitized transactions to retain a minimum 5% credit risk of the assets collateralizing the issuance4. The sponsor does have the option to transfer the retention obligations to B‐piece buyers, but B‐piece buyers are not accustomed to putting up more cash and holding onto assets. CMBS already exists in a competitive environment, and risk retention may only make things more difficult as CMBS shops try to balance underwriting standards with wider spreads.

Looking Forward

Property fundamentals are key moving into 2016. Cap rate compression is beginning to slow down, constrained by rent growth and the overall health of the economy. If treasury yields begin to increase as a result of Fed policy, NOI will have to increase at a stronger pace to justify rising asset valuations. While the next few years may create pressure for the CMBS market, there is opportunity for long term investors focusing on secondary and tertiary markets.

We hope you find this information useful. For more information, or for any comments or questions, please contact CBRE Capital Markets’ Debt & Structured Finance team.

Thank you,